I'm trying so hard to make it look effortless...

Who's with me?

☀️

Livin' La Vida Luna y Luca

Making Blueberry Muffins with Grandma.

Taking away the right lessons from an experience is a lot harder than it sounds.

When things go our way, we might attribute our success to hard work rather than luck.

When things go awry, the opposite is true as well. We might walk away from the experience thinking the timing wasn't right or we got unlucky instead of digging deep and identifying the real reason we failed.

This week I had an opportunity to reflect on both scenarios.

Washington

After just two weeks of being on the market, we're officially under contract to sell our new construction project. 🤞

When I first bought this property in Dec '21, I thought a likely outcome would be achieving a sales price of $1.545M.

Less than 2 years later, we ended up listing at $1.888M & received multiple offers.

If luck and skill were a finite pie, I attribute 1% to skill and 99% to luck in this specific situation.

But a few streets over, a similar home listed for $1.5M.

I had a chance to talk to that developer and asked him what his thoughts were on the delta in price between our properties' asking price ($350K).

Here's what we came up with:

- $100K - New Construction Premium (vs. his addition + renovation)

- $100K - Finishes (My Custom vs. His Builder Grade+)

- $50K - Better Location (I'm closer to the train)

- $50K - Exterior Design (My White & Black vs. His Gray & Black)

- $50K - Interior Design (My light & modern vs. His dark & traditional)

Despite the large gap in sales price, our net profits are going to be similar. Which makes me really wonder - is it worth spending the extra money?

Was it worth:

- The Anderson 400 Black on Black window package

- 360-degree Security System

- Surround Sound Throughout

- Wrapping the house in Blueskin

- Putting a wet bar and mini-laundry in the basement for an au pair suite

- Dormering both sides of the 3rd floor to have a walk-up finished attic

- Installing custom closets throughout the house

- ...and a dozen more "lavish" decisions.

Any chance I had to "upgrade" this home, I took it. Thankfully, the market forgave my exuberance, and these buyers are getting a lot of house for their money.

If I had to do it again (which I'm getting ready to do), I think I'd make different choices.

I'm looking forward to taking austerity measures on my next new build in Florham Park.

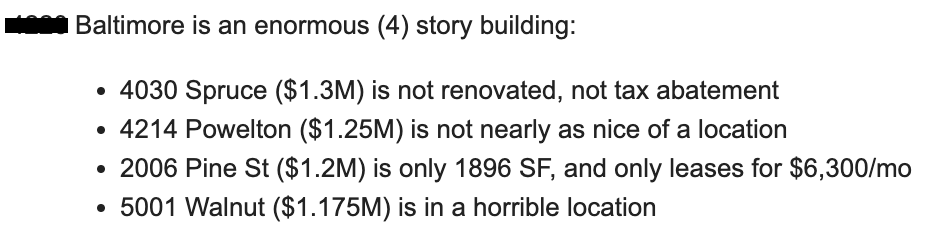

Baltimore

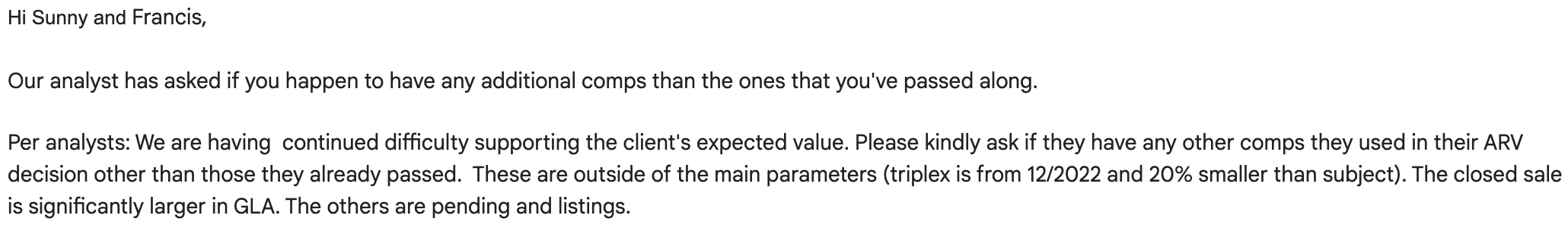

A few days ago, my preferred lender rejected our loan application for Project Baltimore because their internal appraisal came back at $850K.

Meanwhile, we've been estimating an After Repair Value of $1.275M. ☠️

$850K barely covers our purchase (435K) and renovation (400K) costs. It doesn't even scratch the surface of our holding and soft costs (~100K).

What's the takeaway when your lender cuts your valuation by 33%?

At first, I doubted myself and almost walked away from the deal, even though my $10K deposit went hard 2 weeks ago.

But then we dove back into the comps and came away more confident than before. We tried asking our lender to take another look with the following in mind.

They weren't having it. They couldn't see the forest for the trees.

Their loss. We're moving forward on the deal with another lender. I can't wait to find out what we appraise for after completion.

...5 Years Later...

All of this thinking about takeaways reminds me of when I had to close my restaurant back in October of 2017.

I spent months dwelling on what I could have done differently and what lessons I learned from that experience.

5 years later... I realize how "amateur" my takeaways were.

- Restaurants are a bad investment

- Don't go "all-in" on one thing

- Franchises are a bear trap

- No one will work as hard as you in your business

- the list goes on and on...

But none of these quite hit the mark. They are all very specific to that one situation.

Today, with the benefit of time, hindsight, and a modicum of success on my side - I think my biggest takeaway from closing my restaurant is this: Failure is better than mediocrity.

My restaurant business was an absolute dumpster fire. I lost a ton of money (mine & others).

At the moment, closing the doors felt like the absolute worst outcome. But it wasn't.

Having that restaurant be a mediocre success would have been far worse. I would still be playing that game.

I'm so grateful I failed there. Closing that chapter allowed me to explore real estate investing.

Alas, I have lots to learn in this field as well.

I can't wait to see how "amateur" my takeaways on Washington and Baltimore are 5 years from now.