We're purchasing Project Silver Spring on Wednesday, 5/29.

Our architect printed the final plan set on Monday, 5/20, and our lender gave us the clear to close on Wednesday, 5/22.

All of our MEP bids are in and we are ready to start the interior demo on Thursday.

Walking up to the starting line with this level of mental and physical preparation feels like a cheat code: Left, Left, Right, C!

☀️

Livin' La Vida Luna y Luca

We forgot it was picture day (again), but the kids were matching anyway.

Introducing Project Oliver 🏡

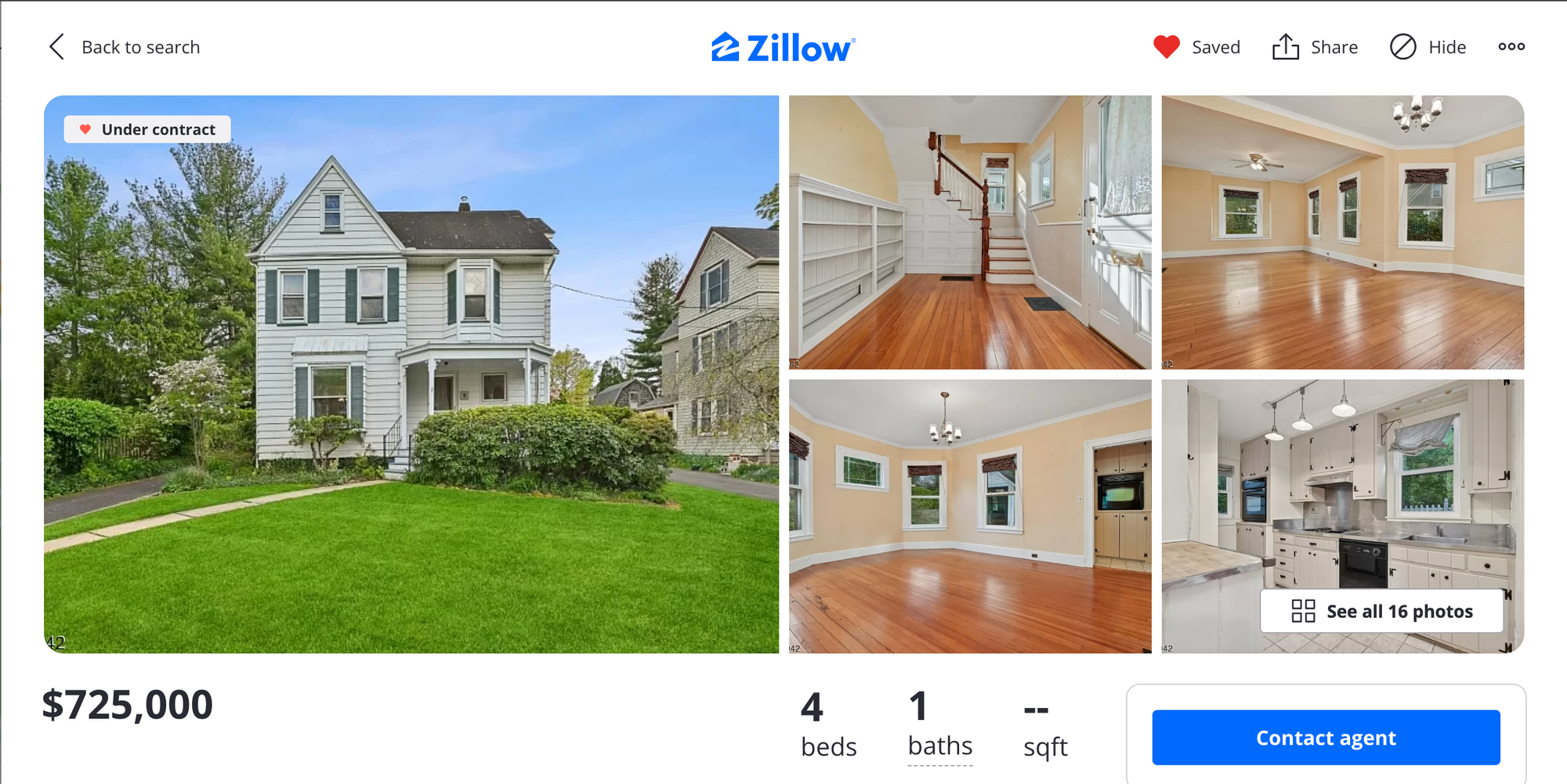

When I saw this listing hit the market I was ready to pounce.

Our initial offer (before the open house) was $825K cash, close in 30 days, with no contingencies other than an underground storage tank sweep.

The seller wasn't willing to stop the open house for that number, but they did give us a last look.

We ultimately locked it up for $865K, which is... honestly pretty high.

Here's why I think it's worth paying a premium.

1) Location

This house is on a very desirable street in a great neighborhood. It's only a few blocks away from Project Washington.

2) Lot Size

This home sits on a 65' wide lot which is 15' wider than the typical lot size in this part of town.

It may not seem like much, but that extra 15' will allow us to build a home with a 2-car garage, which is EXTREMELY rare for the area.

3) Economies of Scale

Project Oliver is right up the street from Project Fairmount. Ideally, both projects move faster and cost less because they're so close together and we'll be able to keep our tradesmen busy for longer / buy in bulk.

Current Status:

Our tentative closing date is scheduled for June 7th.

We're waiting for the survey to come back so we can start developing our floor plan.

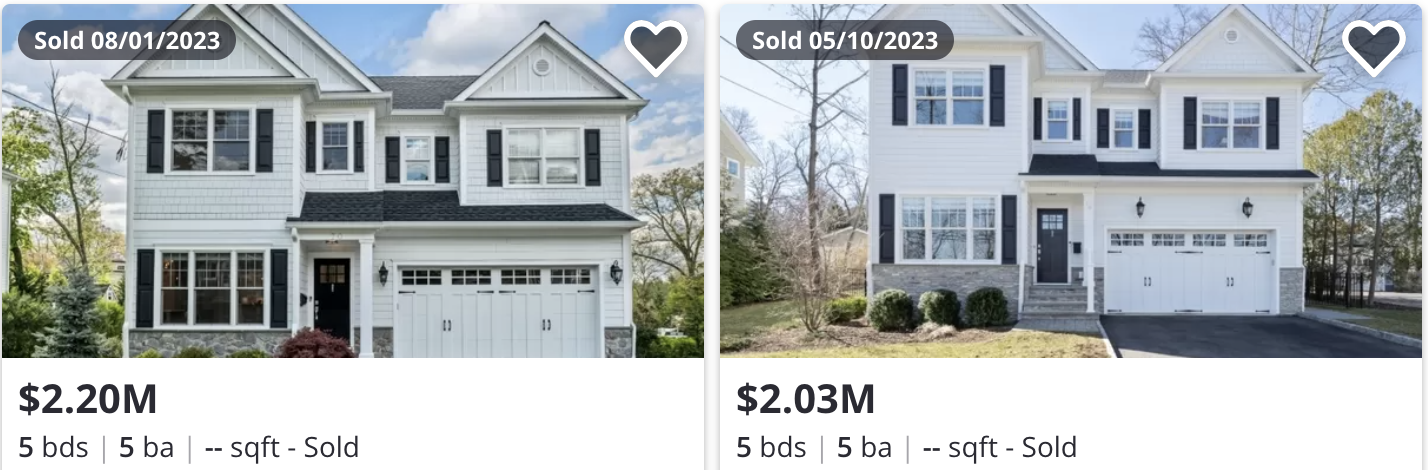

R&D: Ripoff & Duplicate

We're R&D'ing a house that recently sold for $200K above ask in a neighboring market.

We'll change up the patterns and colors, but this is basically what we're going for:

First Floor Layout

The Numbers:

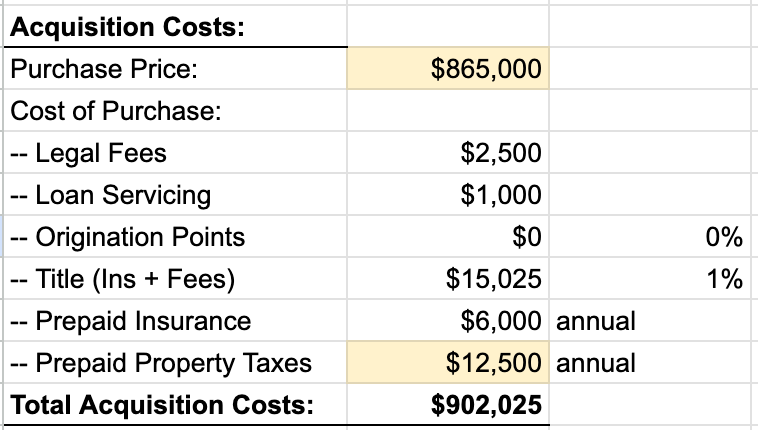

Let's quickly run through the numbers here.

We'll start with three buckets of expenses and end with our comp supported After Repair Value.

Cost to Buy:

The acquisition cost comes out to just over $900K.

Cost to Build:

We expect to spend $740K on the build (including interest).

We expect this house to be 4,250sf of finished space including the basement and attic.

An average build cost of $150/sf brings us to just under $650K on Labor & Materials.

This is essentially the same budget we have for Project Fairmount.

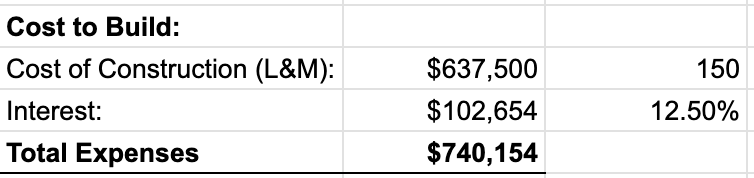

The interest portion is based on the following table:

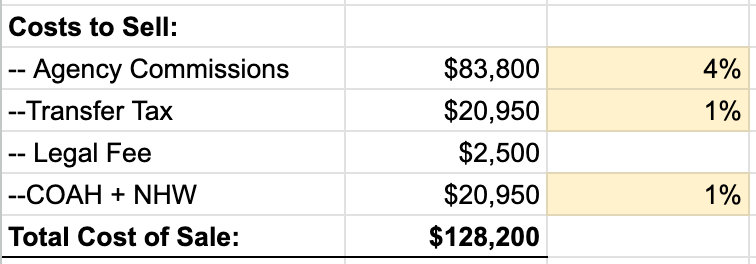

Cost to Sell:

The last expense bucket is the cost of sale, which we project to be $130K.

After Repair Value

Here's where things get spicy.

There are only a pair of 2-car garage comps available to us.

Both of these homes were built in 2019 and resold in 2023. They're also within a 3-minute walk of Project Oliver.

With that said, we're projecting our ARV to be: $2.095M

It's a 5% discount to the higher priced comp and only a 3% premium to the lower priced comp. Right down the fairway with a touch of conservatism.

What's Next?

Our closing date is tentatively scheduled for June 7th! That doesn't give us much time.

Between now and then, it's a mad dash to get our survey finished, our architectural plans finalized, and financing locked in.

Speaking of financing...

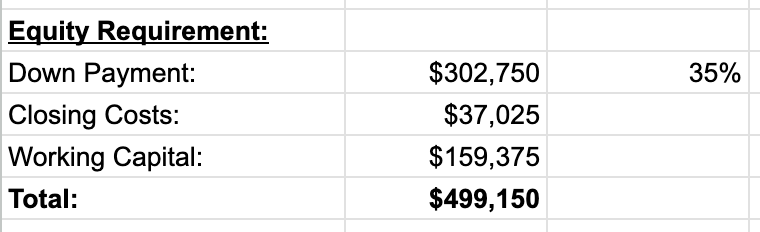

Get Involved!

The cash requirement to fund this deal is $500K(!!)

I'm keeping half of it for myself and looking for a private money lender to take the other half.

As always, if you're interested in participating, please shoot me a text, reply to this email, or schedule a call with me by clicking here.