I sent another offer on a new construction project.

We'll find out tomorrow if they accept.

If they say yes, pls send help ☠️

☀️

Livin' La Vida Luna y Luca

Happy Easter to all who celebrate. We fueled up on Playa Bowls Smoothies before huntin' for some eggs. What a fun tradition. I never did it as a kid, but grateful to experience it through my kids.

Late last year, we couldn't sell Project Catharine for a price that made sense to us.

So we refinanced into long-term fixed-rate (interest only) debt to kick the can down the road.

We found ourselves in the same position on Project Front St.

This was the condo-conversion we did in the Queen Village neighborhood.

Quick Recap:

We bought Project Front St for $580K and spent roughly $320K (all-in) on a gut renovation across 2 units.

We listed the larger (4 bed, 3 bath) unit for $700K, but had no takers. However, we did find someone interested in renting it for $4,500/month. They moved in on March 15th.

Now we are weighing the following refinance options:

Amortized v. IO

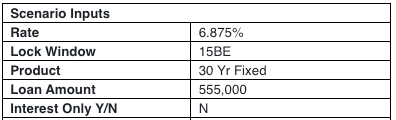

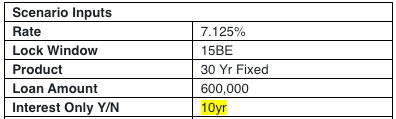

We can get $555K at 6.875% fixed for 30 years or $600K at 7.125%, but pay interest only for 10 years.

The monthly payment works out to be the same.

Wildcard:

The smaller (2 bed, 1 bath) unit is still listed for sale at $375K. We've done 40+ showings and everyone agrees: the location and finishes are great. However, it's a little small.

We'll leave this unit listed for sale because people still request private showings.

Let's get conservative and say we sell this unit for 10% below the current ask ($337.5K) and the cost of sale is another 10% ($33.75K). We would walk with ~$305K for this smaller unit.

Our current cost-basis on this project is $900K. Selling the smaller unit brings our cost-basis down to $600K.

If we refinance the larger unit at $600K (Interest Only option), we'll be into this asset for zero dollars out of pocket. If we take the smaller ($555K) loan, we'd have to bring ~$45K+ to the closing table, which is less ideal.

Waiting Game:

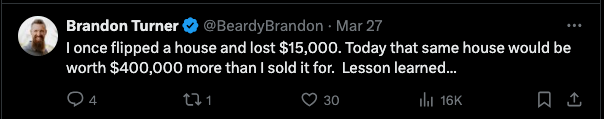

I saw the tweet above earlier this week. It gave me some reassurance.

I truly believe the reason we could not sell Project Catharine or Project Front at our desired price is because of the current interest rate environment and inventory level in their respective markets.

We put ample time, money, and effort into both projects. It would be a shame to see it go to waste by selling and coming out flat, or worse - taking a loss.

I have to believe a little patience will go a long way.