Today is my 10th marriage anniversary. 🤯

We got married in the Parsippany, NJ courthouse.

After we walked out of the judge's chambers, all the "criminals" waiting for their cases to be heard were clapping for us. It was pretty hilarious.

That moment just about sums up the last decade: Not perfect, but fun as hell.

For the day 1's scratching their heads... Yeah - we got married on paper almost 2 full years before our wedding in October of 2015.

☀️

Livin' La Vida Luna y Luca

It's been ~2 weeks since she left and Luca is still asking for Lalis every day when we get home from school 🥲.

I'm a sucker for tradition. This post marks the second year of my Personal Finance Review.

Click here to read last year's post (2022).

In case you missed it, I use Copilot.Money to track our finances - from our income and expenses to our assets and liabilities.

The app costs ~$100/yr and only works on iOS & Mac devices, but after trying every tracker under the sun - it's my favorite by far.

Two "Conflicting" Ideas:

2023 was a year of trying to balance two conflicting ideas I wholeheartedly agree with.

- Ramit Sethi, author of I Will Teach You To Be Rich, says "There's no virtue in living a smaller life than you have to."

- James Clear, author of Atomic Habits, says "Save more money than you think you need. Life is unexpected and your future tastes will likely be more expensive. Not worrying about money tomorrow is worth more than whatever you could buy today."

From my perspective, both can be true: Live a rich life today, live a richer life tomorrow.

Net Worth

After staying relatively flat for most of the year, our net worth shot up by 31.52%. There were three main contributors:

- The SP500 was up ~24% on the year and that's where >50% of our money is.

- The sale of our new construction project provided a healthy profit.

- Bitcoin & Ethereum were both up 100%+

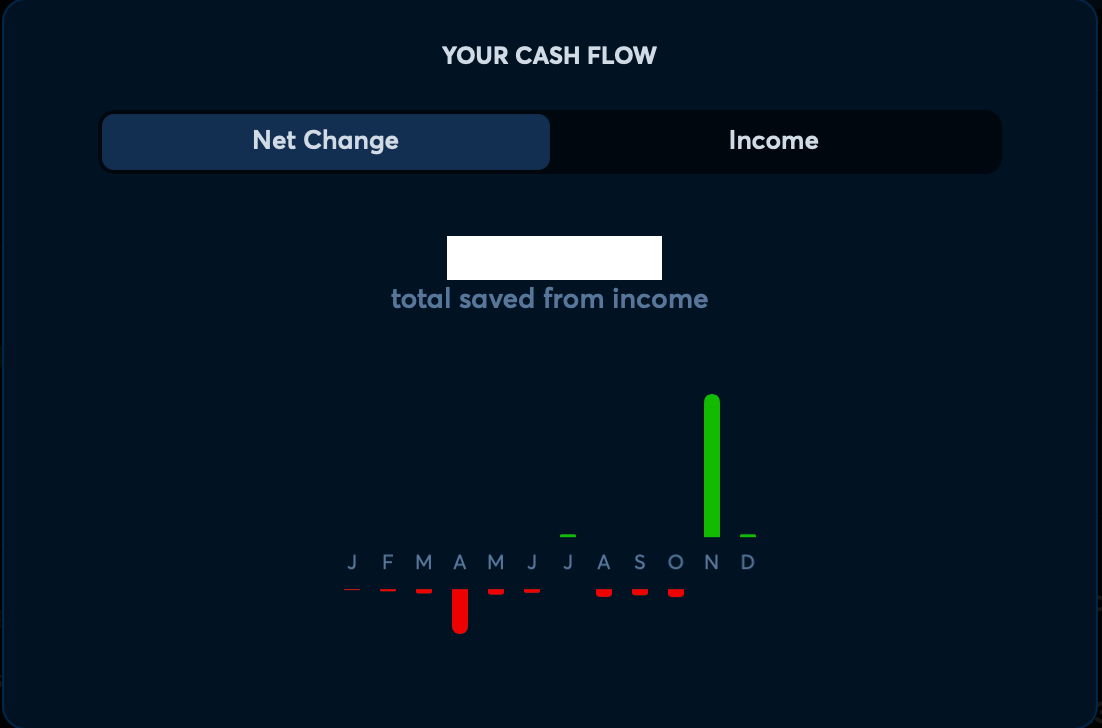

Cash Flow

We were cash flow positive for only 3 months of the year: July, November, and December.

Every other month we ran at a deficit.

Our monthly burn rate in 2023 was about ~25% higher than in 2022. Most of that is because we moved Luna to a new (more expensive) school and Luca joined her.

Despite running at a deficit for 75% of the year, the income generated in November from the sale of our New Cons project forgave all our bad behavior and then some.

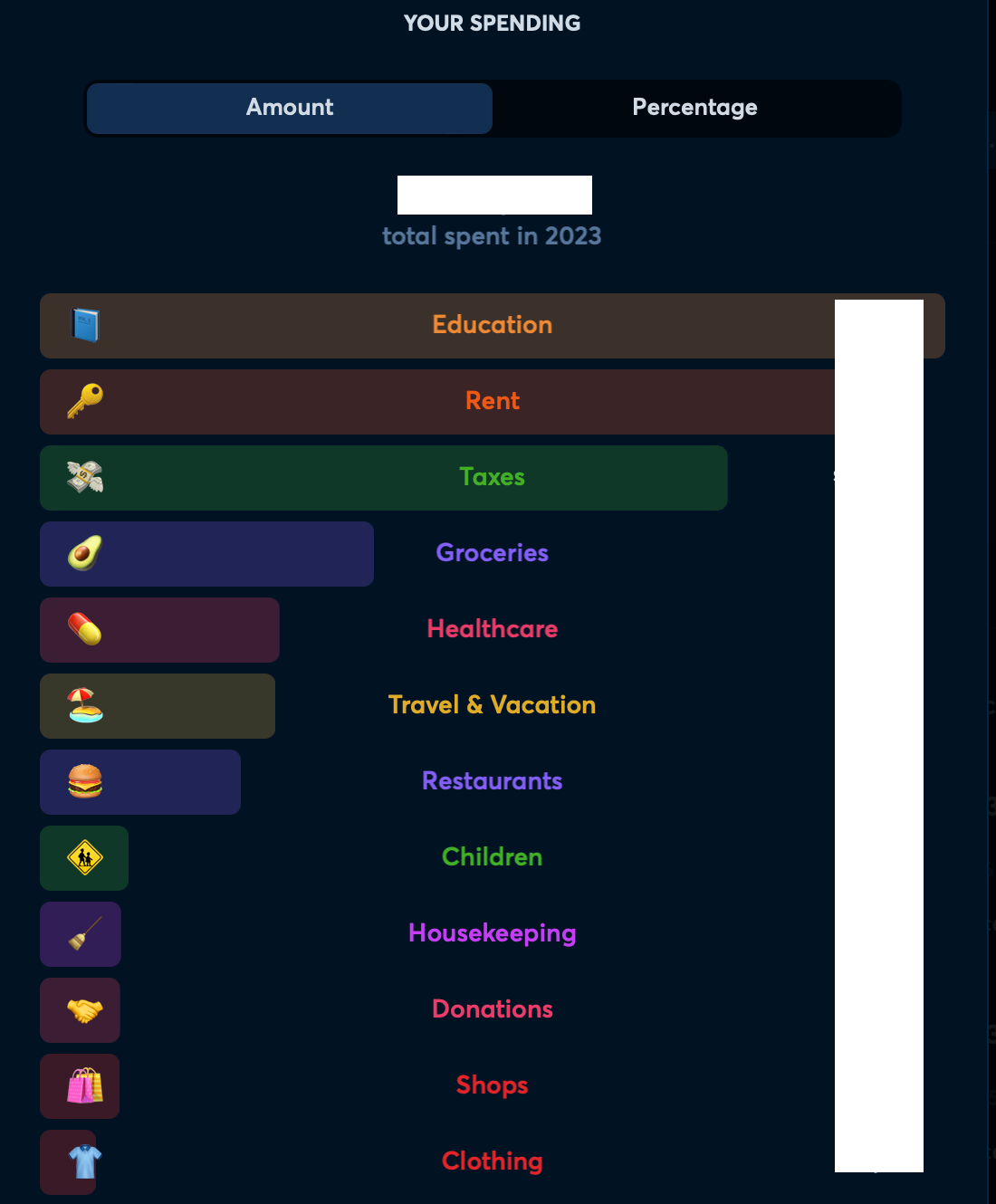

Spending

Like a good Indican family, our largest expense is our kid's education, followed closely by our rent. The tax bill is what I owed for 2022 (Dia pays her share via her paycheck).

The Healthcare category was high because we had to pay out of pocket for insurance for 6 months and that wasn't cheap. But Dia got a new job and her health benefits are super saucy. Now that Luca is a little older, we'll look to repurpose those healthcare funds into more traveling.

Looking Forward

Here are a few personal finance goals for 2024 in no particular order:

- Increase net worth by 15%

- Assuming SP500 returns 7.5%

- Cashflow positive for 6/12 months

- Dia's new job will surely help with this

- I'm on track to sell at least 5 properties this year

- Spend 1.5x more money on Travel

- Looking to take ~5 trips this year

- Spend 2x more on buying back time

- Virtual Assistant

- More help around the house

- Spend more on celebrations

- Life's too short.