Another awesome week in the books.

2023 has been off to quite an eventful start.

🏀 Monday night I went to the Knicks vs. Bucks game with an old friend.

👨🏽💻 Tuesday I wrote and recorded 6 more shorts. We're going to start dropping those daily soon.

🥗 Wednesday I did a 2 (maybe 3🤷🏽♂️) hour lunch with a couple of friends.

🏡 Thursday I met with Mary Weichert. Yes, that Weichert.

🎉 Friday we celebrated my Masi's (Mom's Sister) birthday with a 🍕 party.

🏃🏽♂️ I also ran 15 miles this week.

Livin' La Vida Luna y Luca

Gnight Luquito

What gets measured, gets managed.

- Peter Drucker

When the summer's about to hit, I start tracking everything I eat with MacroFactor.

When there's a half-marathon on the calendar, I start tracking all my workouts with Nike Run Club.

When my money's on the line (which is always), I track every penny with Copilot.Money

Copilot is the first personal finance app I've stuck with for more than a year, and I've tried them all:

- Mint

- Personal Capital

- YNAB (You Need a Budget)

- Quickbooks

At $70/year, I'd consider it a splurge.

But the user interface and user experience are so good (only available on iOS devices).

2022 was my first full year using the app so I was pleasantly surprised when they generated a year-end review for me.

If you like what you see, use my code to try one month of Copilot free: W4X88T

2022 in Review

In 2022, we did a little more than 5 transactions per day. The takeaway here is to simplify.

We have money in so many different places. The transfers between accounts are adding up. There's definitely an opportunity to consolidate.

We have money with:

- Chase: 1 Checking, 4 Credit

- Capital One: 1 Checking, 5 High Yield Savings Accounts (HYSA)

- Fidelity: 6 Tax-Advantaged Retirement Accounts (TARA) + 1 Health Savings Account (HSA)

- Prudential: 1 TARA

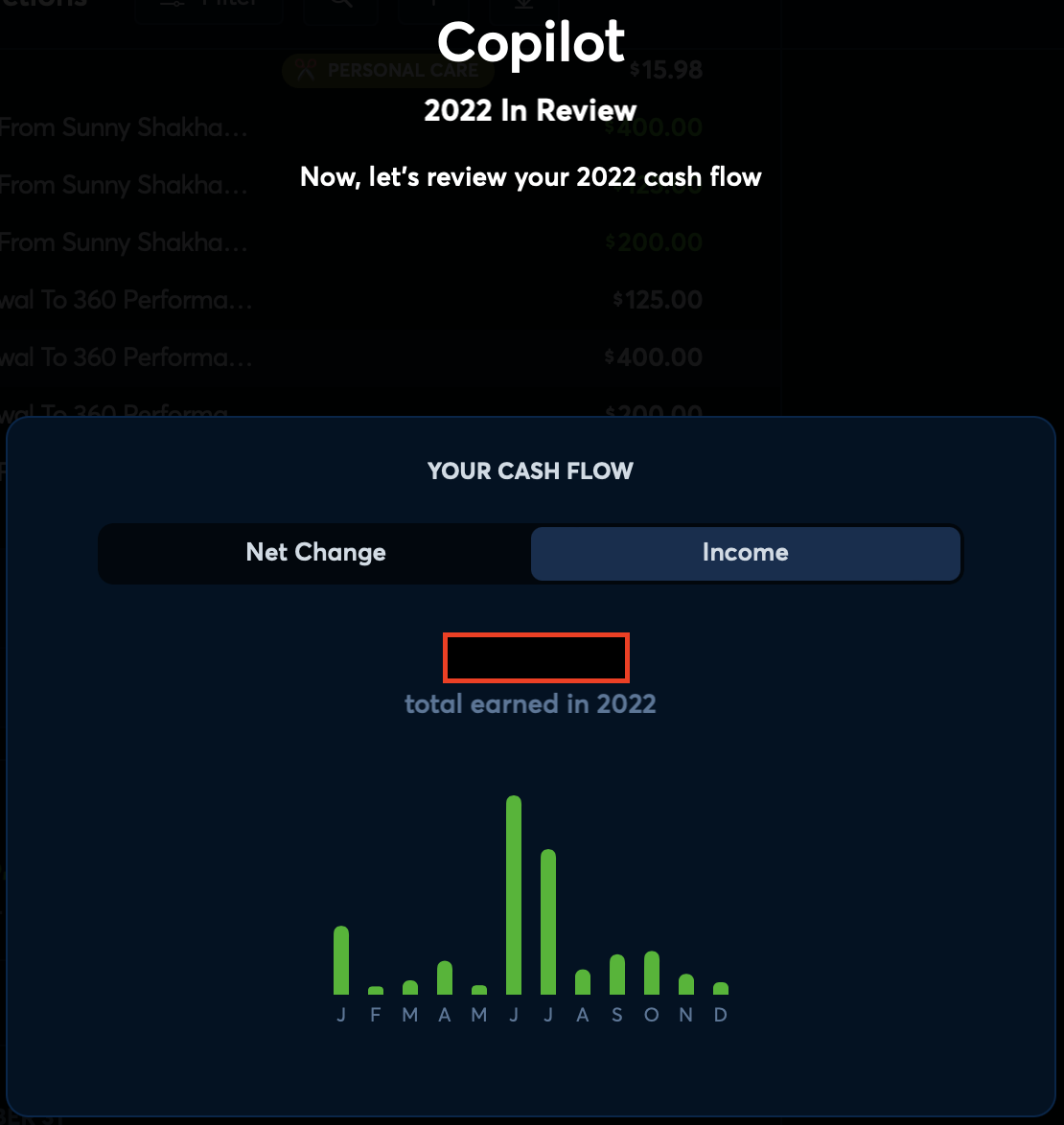

Income Distribution:

2022 was a rollercoaster of income.

We started out the year pretty strong with the sale of a 200-unit apartment building in North Carolina.

June and July turned out to be monster months for me with back-to-back fix and flip sales. These two months accounted for 55% of our total annual income.

Dia spent ~6 months on maternity so her income was touch and go for a bit. Although her new company stepped up in a huge way by making her whole after her short-term disability expired.

This feast-or-famine style of income is incredibly stressful.

It's especially hard to make long-term plans (like buying a house) when I don't know when or where my next paycheck is coming from.

2022 was a breakout year for me.

It was the first time I outearned my 9-5 salary from the job I quit in 2014.

It took 8 long years, but boy was the juice worth the squeeze.

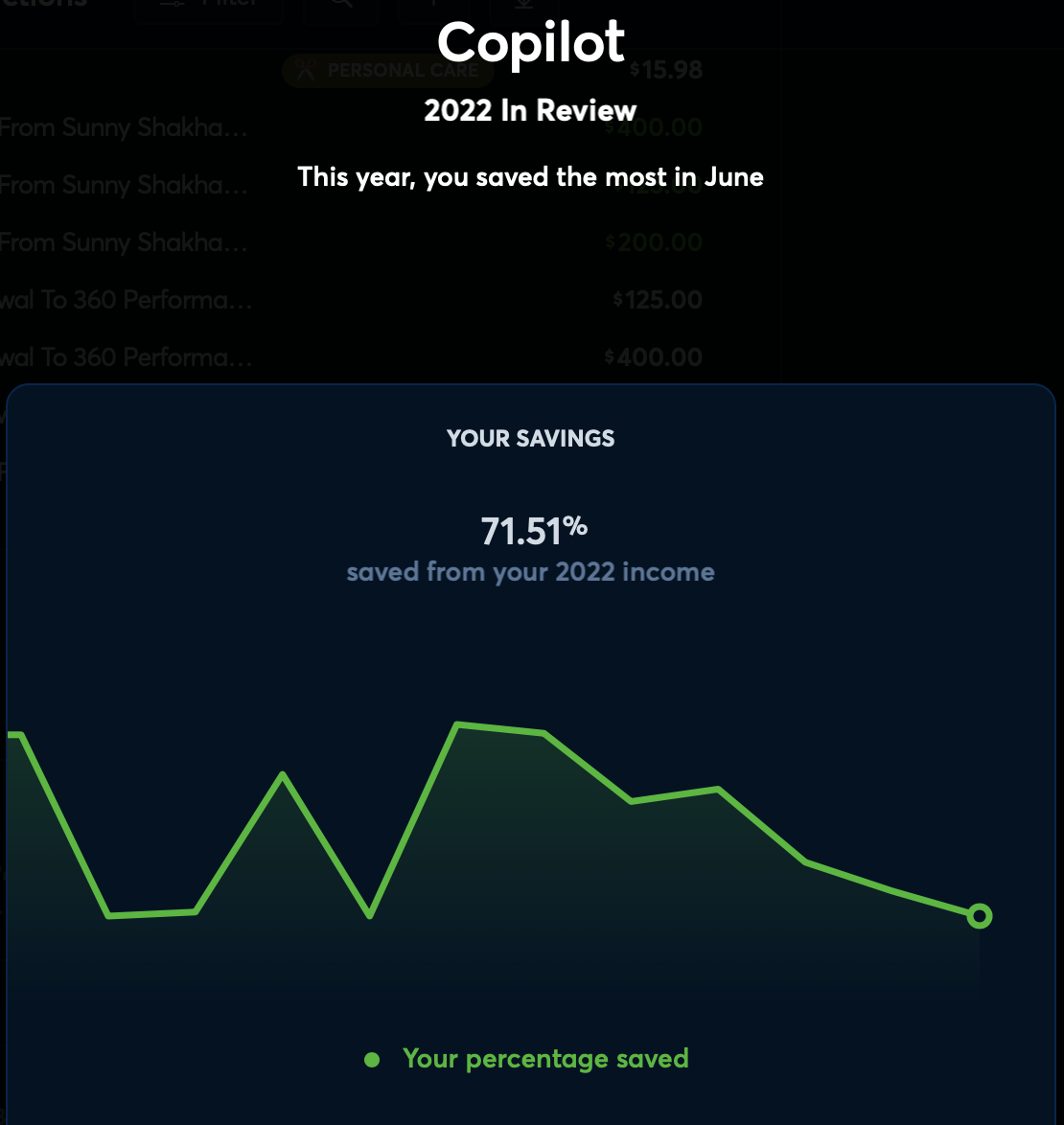

Savings Rate

Unfortunately for Dia, I am the King 👑 of saving (& investing).

We managed to save/invest 71% of our income in 2022.

My borderline obsessive-compulsive commitment to saving & investing stems from the highly unpredictable nature of my income.

I am scared:

- It'll all go away

- It won't be enough

- I'll die before solving the money problem for my family

#DramaKing

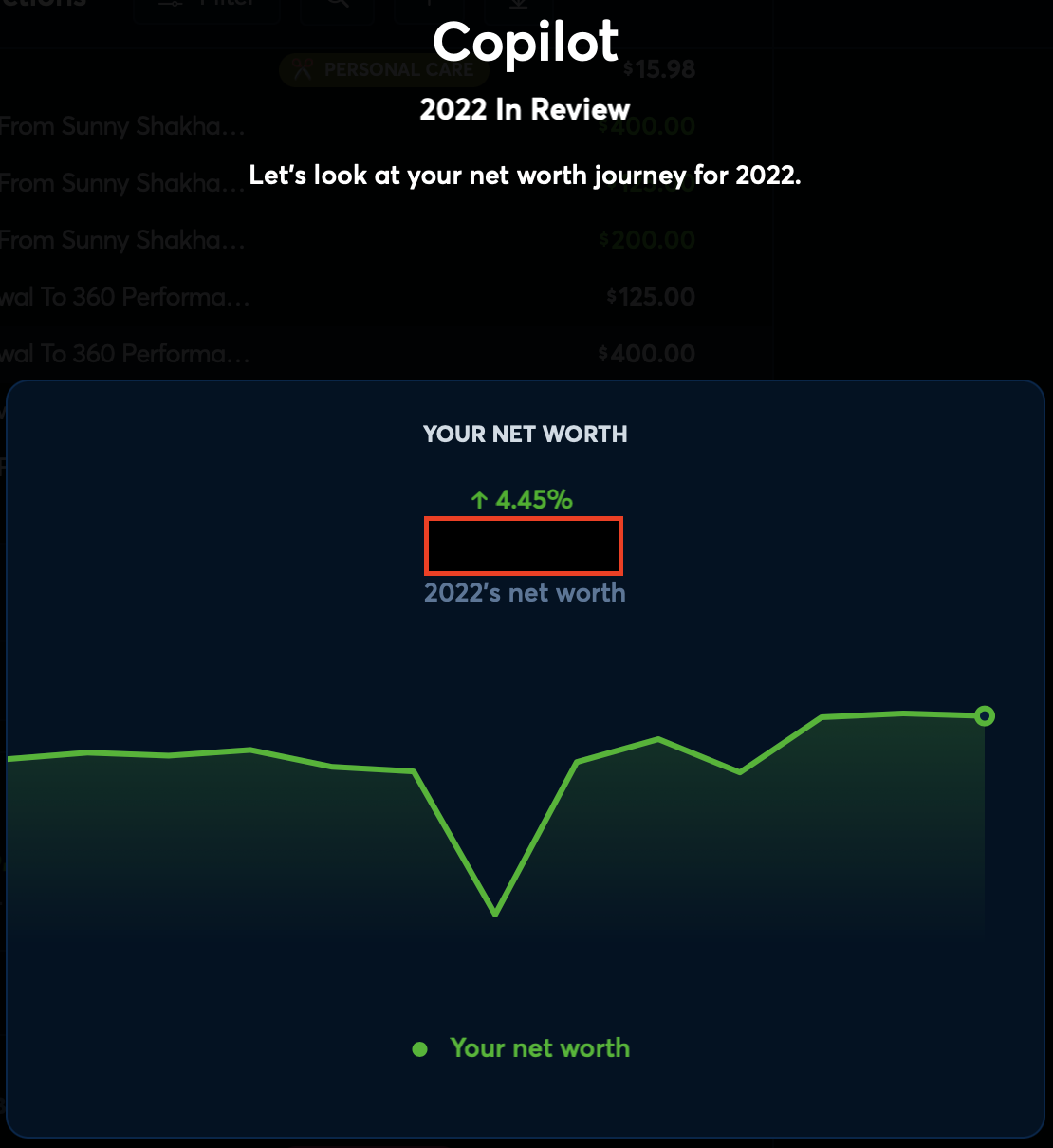

Net Worth Tracker

This is where the rubber meets the road.

Despite having a banner year in income and savings, our net worth barely moved.

This is because of our...

Investment Returns

The market took a major 💩 (SP500 Index down 20%).

Somehow I managed to outperform the SP500 index. You can start calling me Sunny Buffet.

NBD. These funds won't be touched until we're old and gray. And by then the average annual return will smooth out to ~8%/year anyway.

If anything, 2022 was a buying opportunity for anyone under 40yo (not meant to be insensitive to anyone whose livelihood was impacted by last year's economic downturn).

Spending Categories

Rent was obviously our biggest expense and the kid's school was right behind that.

I am ecstatic that our grocery bill was higher than our restaurant bill in 2022. This might be the first year we achieved that.

Dia and I struggle with consistently cooking at home. We just love the convenience and experience of eating out.

I thank Luca. Having a newborn makes consistently going out for dinner a little less exciting.

He's also the reason healthcare was our 5th largest expense. #TotallyWorthIt

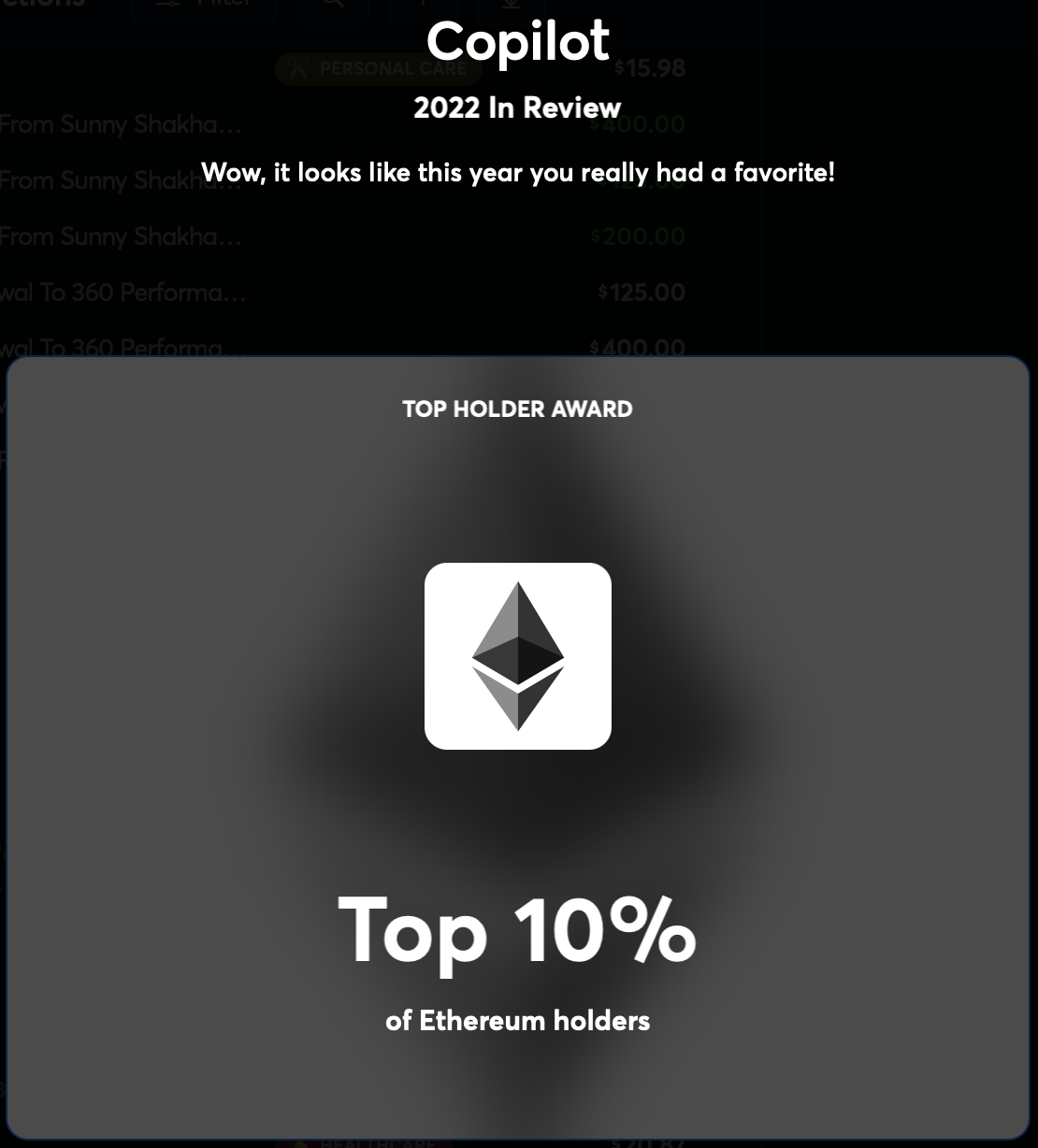

Crypto:

I'm not particularly proud of this, but I started Dollar Cost Averaging my way into Bitcoin and Ethereum 2 years ago.

Every Monday I (automagically) buy a little bit of both.

This is purely speculative and I assume all of this money will vanish.

With that said, I also wouldn't be surprised if this ends up paying for my kids' college tuition. Time will tell.

I do NOT recommend this investment strategy.

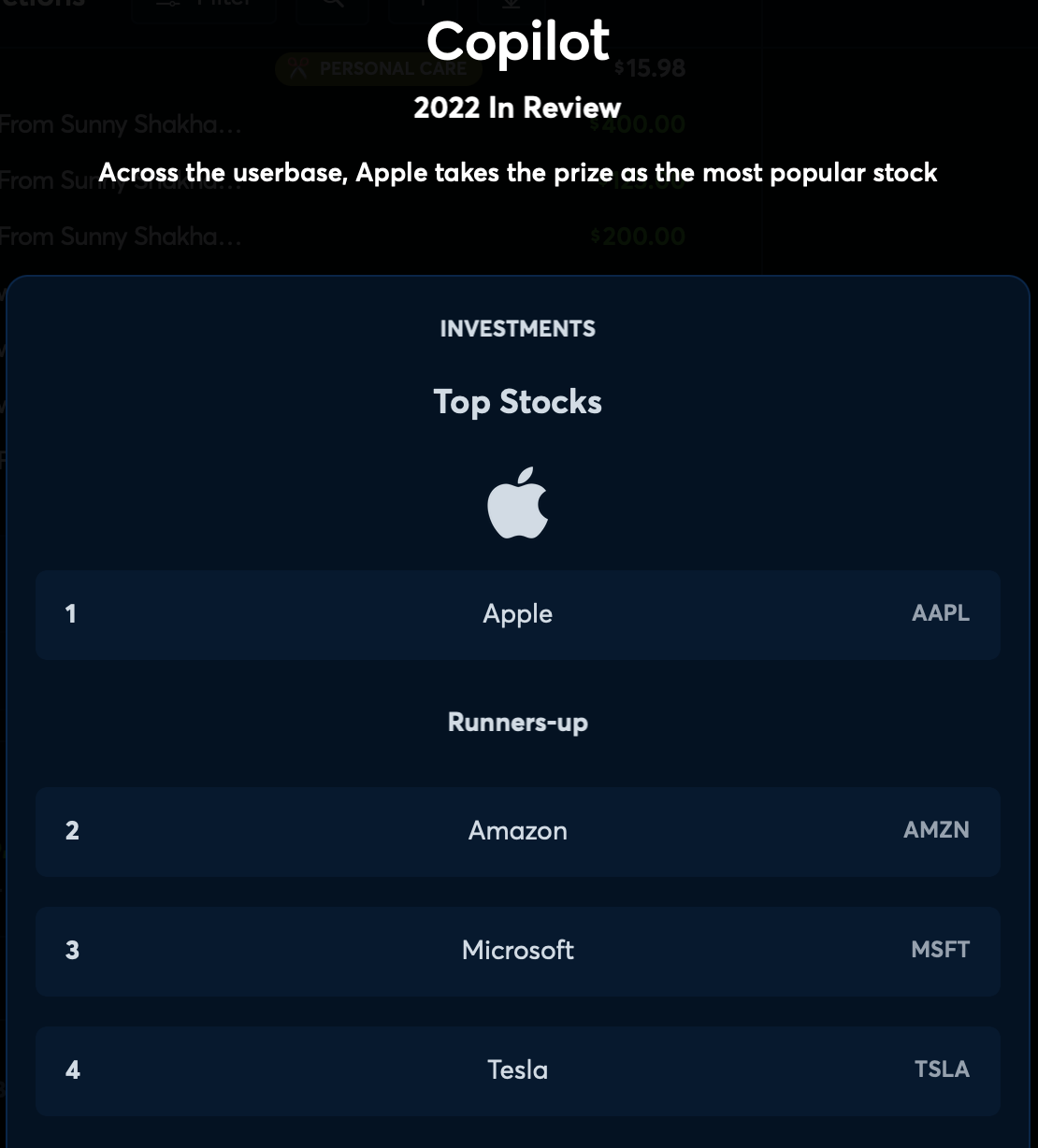

Top Holdings

No surprise here. Our top holdings are the largest market cap companies in the US.

That's because we only invest in index funds like FZROX (Fidelity) & VTSAX (Vanguard).

I vow (again) to never make a single stock purchase (again).

🧐 What's The Point?

The point of this email isn't to share my savings rate, investment returns, or top holdings.

The point is to stress the importance of the first sentence: What gets measured, gets managed.

Having this information at my fingertips helps me make money-related decisions better.

If you like what you saw and want to start tracking your finances with Copilot, use my code to try it one month free: W4X88T

Wishing everyone reading this a prosperous 2023.