After 3.5 years and dozens of abandoned application processes, Dia and I secured a Life Insurance Policy.

What finally got us over the hump?

Well, it wasn't a what. It was a who. Her name is Brigitte Bromberg.

I cannot recommend Brigitte enough. Please reach out to her if you're curious to learn more about life insurance.

In related news, part of the application process was a blood test.

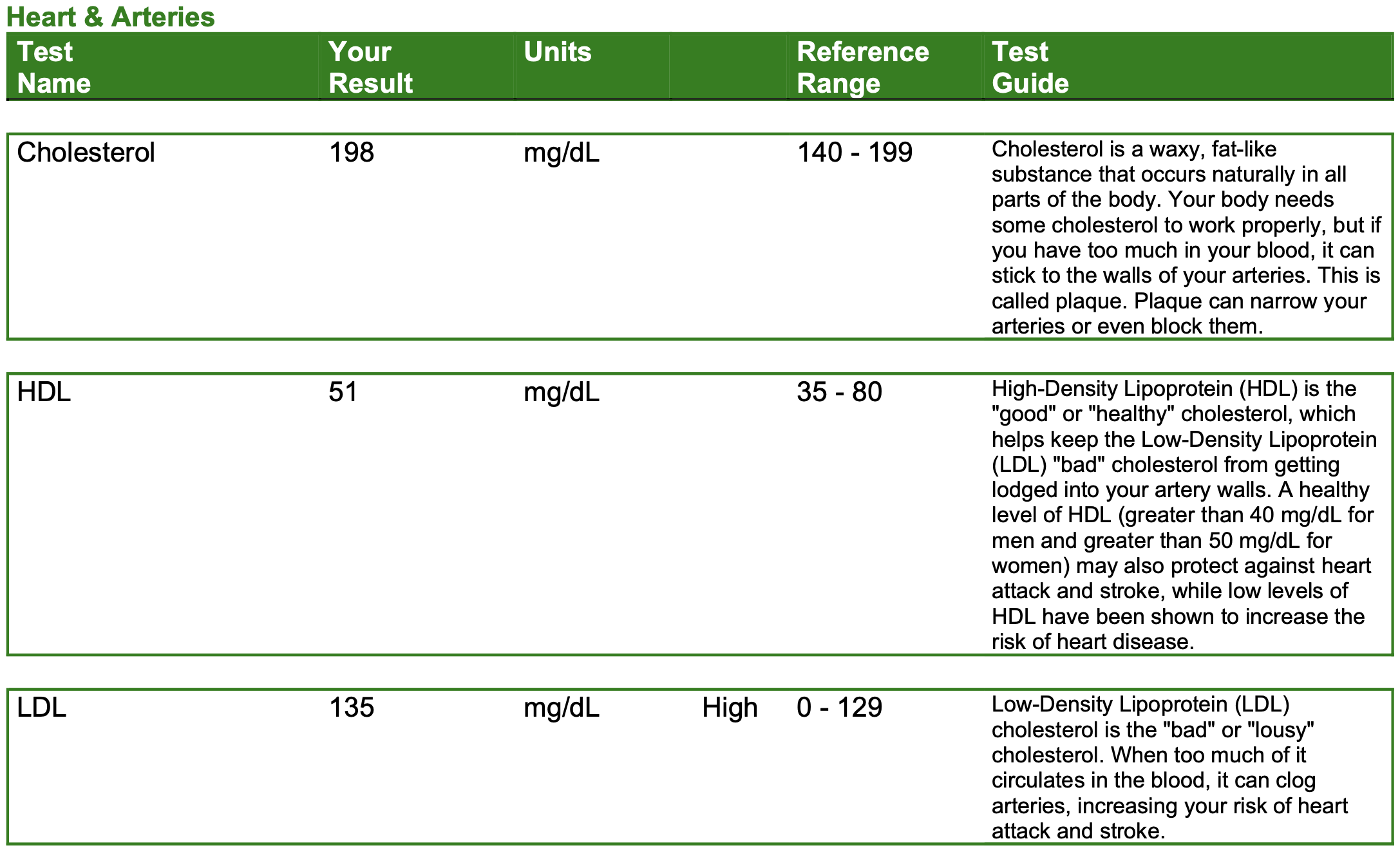

If you've been with me for a while, you probably know I've been hyper-focused on lowering my Total and LDL cholesterol.

🎉 Check It Out 🎉

As of May 25th, I got my Total Cholesterol under control and my LDL is only slightly above the reference range. 💪💪💪 👊👊👊

The job's not finished - still have room to improve.

Birds fly. Fish swim. Deals Fall Through. That's just the way these things go.

When it comes to wheeling and dealing, it's very important to detach yourself from outcomes. This is something I try to remind myself every time I start counting my chickens before they hatch.

In May alone, I had 3 deals fall through.

1532 Catharine Sale

I've written about this project extensively here, here, and here so I won't belabor the point.

Basically, I had the expectation that my partner and I would be able to sell this property for ~$750,000+ after buying and renovating it for a total cost of $650,000.

After closing costs, I was expecting to split a net profit of $60,000.

As you might already know, we weren't able to sell the property for the desired price.

So we decided to pivot and refinance into long-term fixed-rate debt so we can add it to our portfolio of rental properties.

Not an L, just a delayed Win.

1532 Catharine Refinance

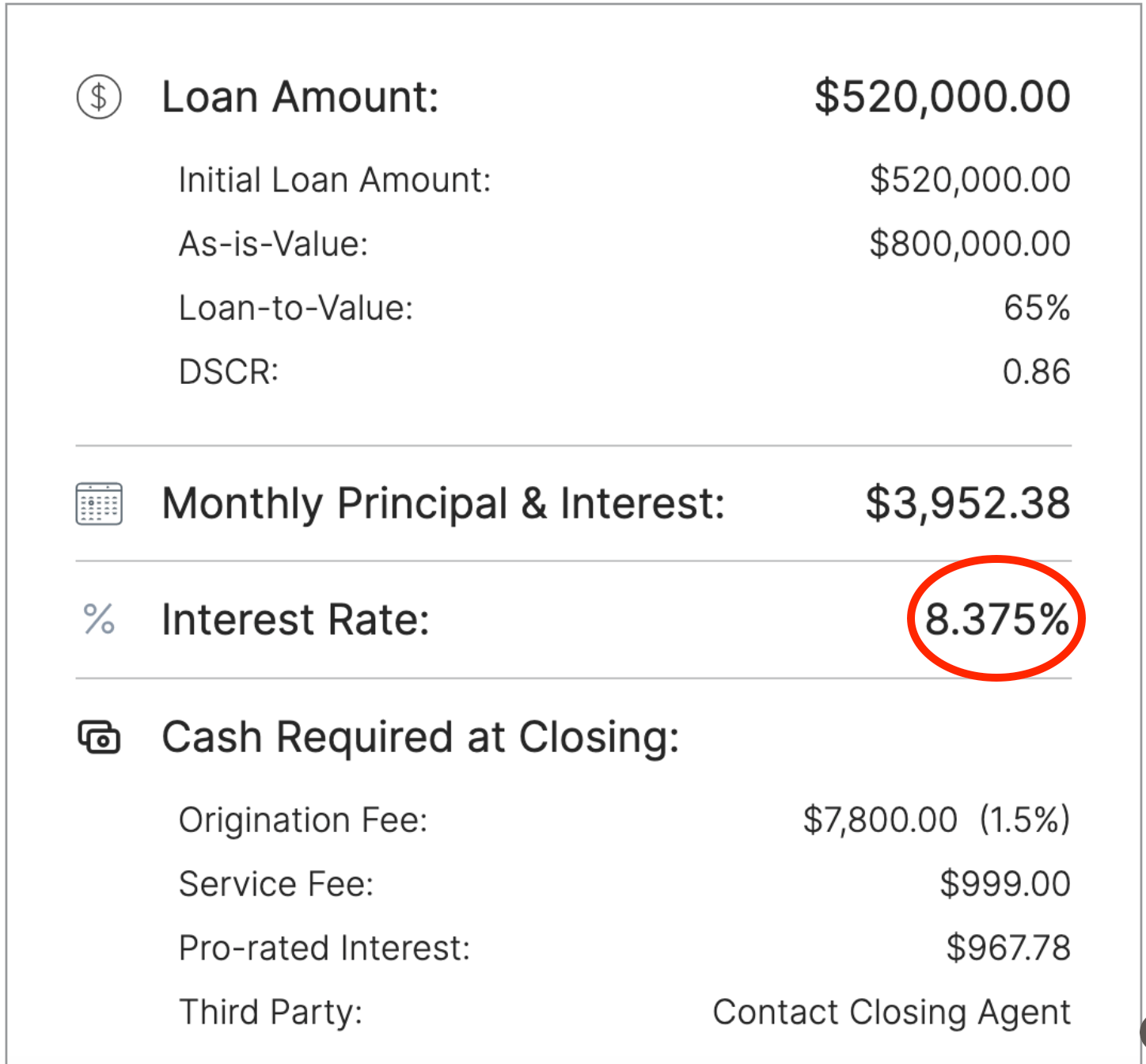

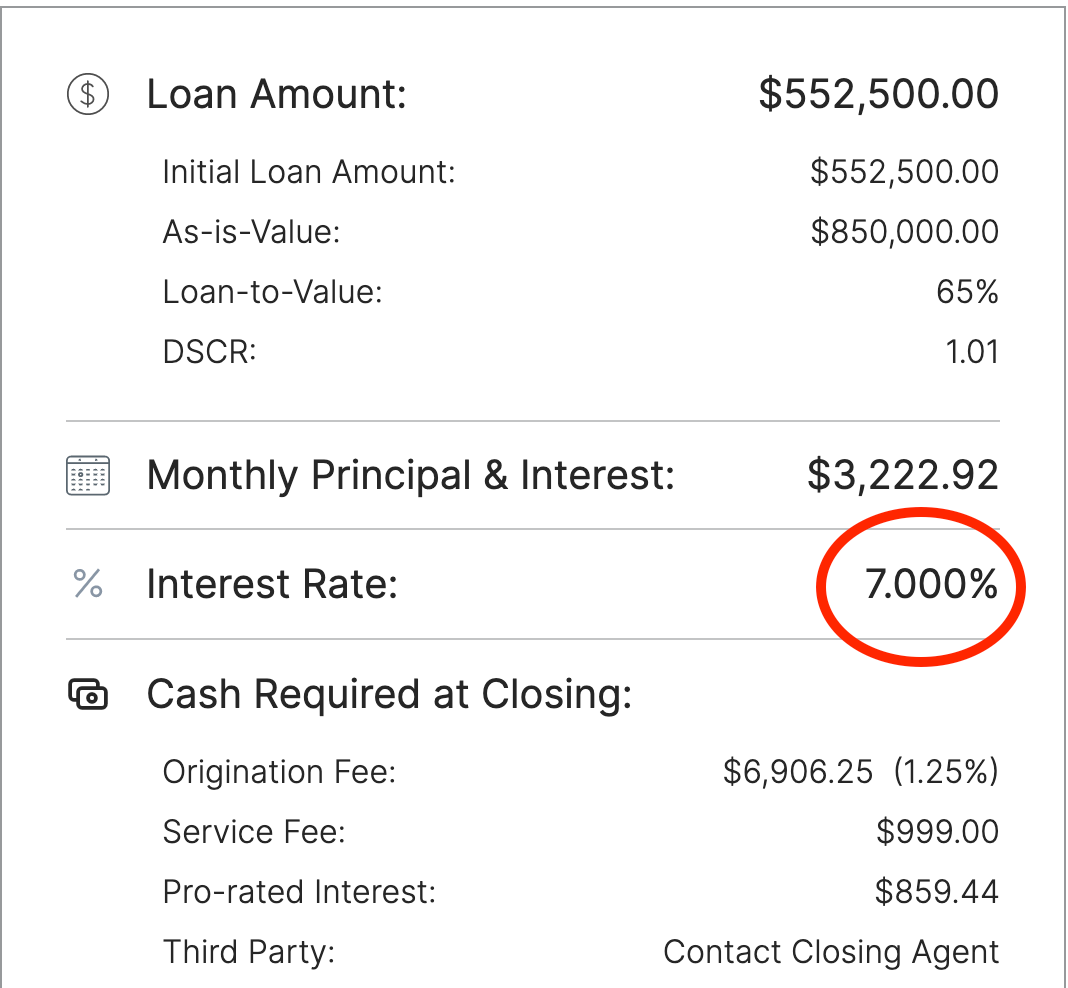

When I applied for the refinance with my DSCR lender, they were advertising rental property loan rates at 6.875%.

They ran my credit (ding), charged me for an appraisal ($650), and then sent me the following term sheet:

As you can see they bait and switched the interest rate to 8.375%.

1942 W Broad

Finally, I originated a short-term loan to a friend back in March.

He was at the tail end of a new construction project and needed some money to get across the finish line.

The original closing date was scheduled for May 3rd so I sent my Payoff Statement to the Title company handling the transaction.

Then we got pushed a week to May 10th...

Then we got pushed to May 17th...

Then we got pushed to May 22nd... I wisened up and updated my Payoff to be good until the 31st.

Then we got pushed to the 26th...

Do you see where I'm going with this?

It wasn't looking good.

How To Deal

Ultimately, the deal closed on June 2nd - a full month after originally scheduled.

What am I getting at?

It's not enough to know that birds fly, fish swim, and deals fall through.

You must also...

- Behave Accordingly

- Be Cognizant of Sunk Costs

- Stay Calm & Be Persistent

Behave Accordingly

You need to be flexible in your approach and plan for multiple exit strategies.

Luckily for my partner and I, we are in a position to hold and refinance 1532 Catherine instead of having to fire sale it at a loss.

In terms of the loan to my friend, I made that loan on March 1st, 2023 fully expecting it to take 90 days to pay me back.

It ended up taking 93.

Closing on May 3rd would have been a pleasant surprise - but closing on June 2nd ended up being a welcomed reality.

Be Cognizant of Sunk Costs

Deals tend to fall through when both parties don't have enough skin in the game.

For the loan I made to my friend, I wasn't worried at all about being paid back because by the time I made the loan, the property was already under contract to the end buyer.

The buyer put down a hefty non-refundable deposit and paid for substantial upgrades, which added up to multiple 6-figures of sunk costs.

There was simply no way they were going to walk away.

Stay Calm & Be Persistent

When my DSCR lender bait and switched the rate from 6.875% to 8.375%, I could have thrown a tantrum and given them an earful before taking my business elsewhere.

Instead, I got on the phone with my loan officer's boss and managed to shift some numbers around.

We settled at 7% interest. I also negotiated a reduction to the origination fee (.25%) and increased the loan amount by $32,500.

This is how you win, even when you lose.

Repeatedly hit 'em with the silencer.