I originally planned to share my notes from Psychology of Money this week, but something more interesting came up.

Maybe next week.

Livin' La Vida Luna y Luca

How long until they get sick of Mommy's burning desire for matching outfits?

Having friends in "high places" has its perks.

This past Tuesday morning, I received a wonderful text from my buddy, Francis.

Here are the details:

- 1532 Catharine St Philadelphia, PA

- Submarket: Graduate Hospital

- 16' wide x 37' long (4 floors incl. basement)

- Purchase Price: $500K

- Renovation Budget: $100K

- ARV: $800K (Conservative)

Gross Margin: $200K ✅

Reno Budget?

The house was built in 2009 so it just needs to be refinished.

- $5,000 - Demo / Cleanout

- $15,000 - New Flooring Throughout

- $15,000 - New Kitchen (Appliance + Counters + Cabinets)

- $20,000 - 2 New Bathrooms

- $5,000 - Create Bedroom in Basement

- $10,000 - Exterior Work

- $30,000 - Contingency 🤷🏽♂️

Reno Budget: $100K ✅

Who's Doing The Work?

Since this is a small job that only requires a few subcontractors, Francis is going to manage the project for a small PM fee (10-15% premium to cost).

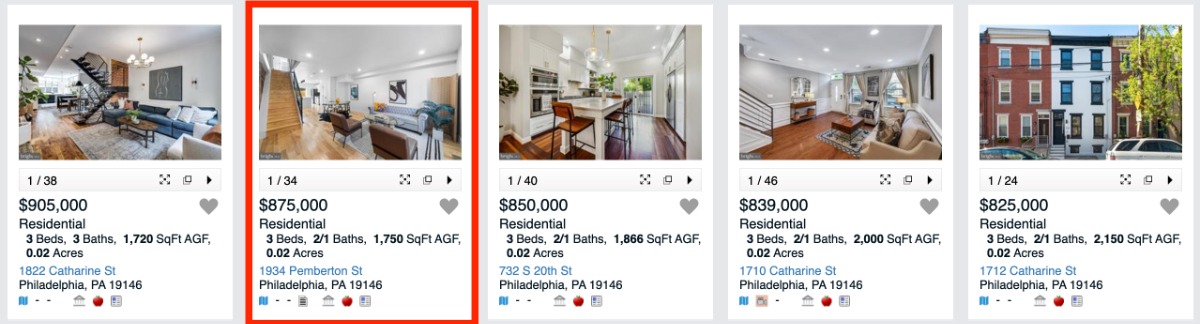

Here are a few pictures from one of Francis' latest projects. We'll be using similar finishes on this project.

This house is less than a mile away from our subject property (same submarket) and was appraised for $915,000 during the summer of 2022.

This house is also much smaller than the property we're buying. The footprint here is only 16'x31' vs. our 16'x37' on 1532 Catharine.

What Type of Financing?

We're receiving 100% of Purchase & Construction at 3 points and 9% interest only.

That. Is. Expensive.

But, 100% financing is hard to come by and Francis already negotiated the funding so we'll take it.

3 Points on $600K: $18,000

9% Interest on $550K: $24,000 (6 months)

Total Financing Costs: $42,000 ✅

What Do The Comps Say?

The comps are strong. All of them are above $825K.

Francis believes our best comp is 1934 Pemberton, which sold for $850K.

Reminder: we underwrote our ARV (After Repair Value) to $800K.

Partnership Structure:

Equity:

- 50% Francis

- 50% Sunny

Roles:

- Francis: Project Management (in the field)

- Sunny: Admin (from a distance)

Fees:

- 2.5% Buyer's Agent Commission on Purchase: Francis

- 2.5% Seller's Agent Commission on Sale: Francis

- 12.5% PM Fee on Cost: Francis

Equity Contribution:

- $25,000 Sunny

- $25,000 Francis

Senior Debt:

- $500K plus $100K in construction holdback

P&L ProForma:

(+) $800K: Sale Price

(-) $500K: Purchase Price

(-) $100K: Construction Budget

$200K: Gross Margin

(-) $60,000: Cost of Sale (7.5%)

(-) $12,500: Project Management Fee

(-) $18,000: Points

(-) $24,000: Interest

(-) $6,000: Property Tax

(-) $1,000: Insurance

$121,500: Operating Expenses

(+) $200K: Gross Margin

(-) $121,500: Operating Expenses

(+) $78,500: Net Margin

Margin for Error

$200K of gross margin is usually not enough for two people. As you can see, that number dwindles down significantly after factoring in operating expenses.

However, the reason I'm excited about this deal is Francis underwrote it more conservatively than I would.

I can't imagine spending $100K on the renovation. We have a $30K contingency. I understand shit happens. But 30% of the total cost is a lotta 💩.

The footprint for this home is 16x37. That's 600sf per floor.

1,800sf is above ground and there's a 600sf basement.

I imagine we'll spend roughly $40psf above ground ($72,000) and $8K in the basement to recarpet, repaint, and add a door + wall to carve out a bedroom.

There's an opportunity to recapture $20K in our reno budget.

As far as the ARV goes: I think $800K is light, but I won't argue because Francis is the King of Philly RE.

All of the numbers he sent me make me believe we can achieve >$825K.

There's an opportunity to add $25K to our outsale price.

If we can take advantage of both opportunities, we have a legit chance at increasing our net margin by $22.5K per partner.

Countin' My Chickens

This $25K investment should net me ~$40K in 6-8 months if things go according to plan.

If the market doesn't fall off a cliff and Francis keeps a tight leash on the reno, maybe we can achieve an extra $25K each.

Time will tell.

In the meantime, I'll be over here countin' my blessings 🙏🏽 that he decided to call me with the opportunity instead of doing literally anything else.