This week's post won't be published on my website until the transaction is complete or falls apart. Continue reading to find out what I'm talking about.

Warning: It's a long one. 😬 Hope you enjoy it.

Livin' La Vida Luna

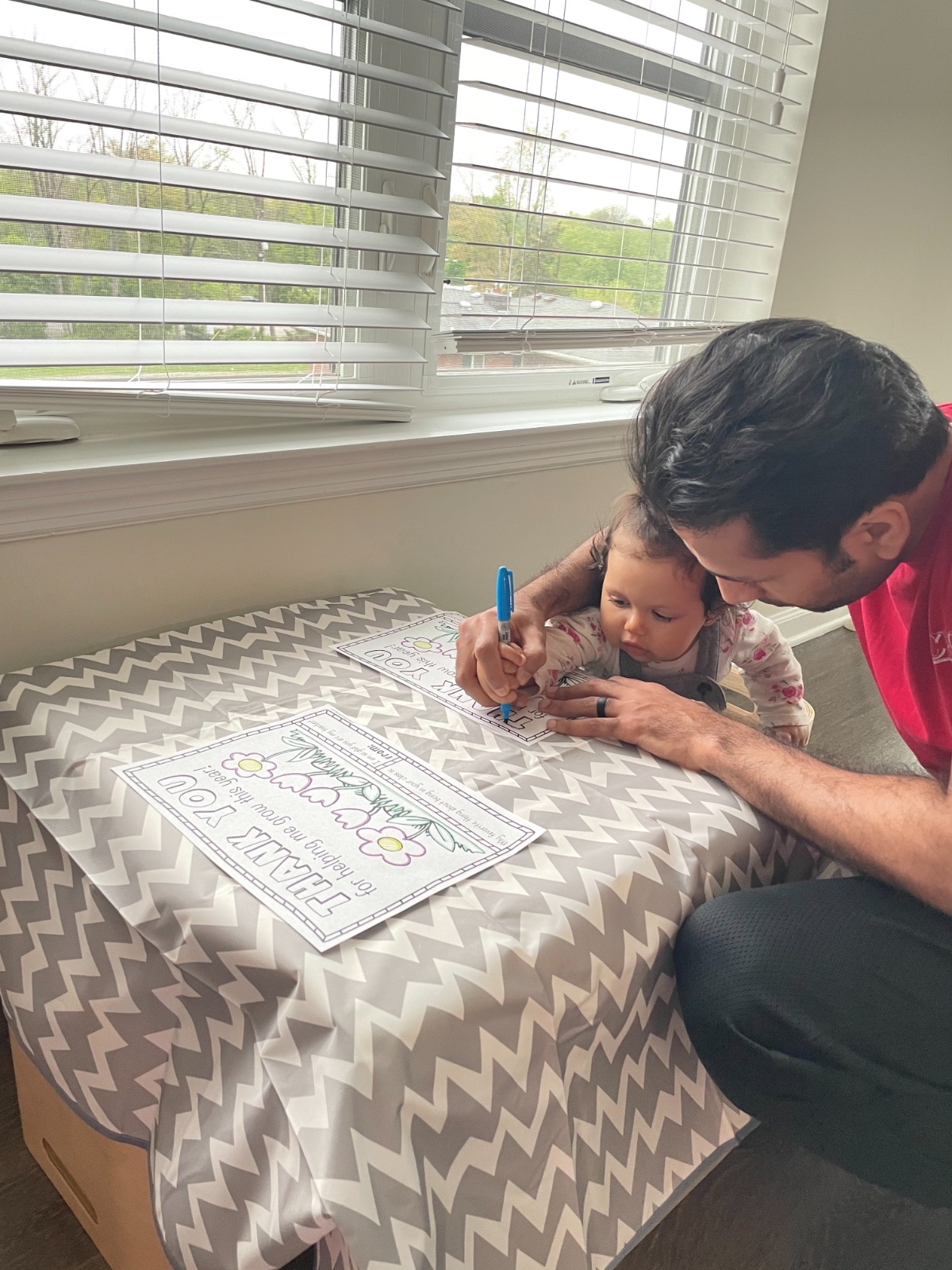

Here's a pic of Luna and me coloring in Thank You cards for Teacher Appreciation Week.

An Opportunity of a Lifetime

In today’s red-hot real estate market, it’s increasingly difficult to find motivated sellers to buy properties at a discount.

To combat this, I started sending postcards to distressed homeowners back in March 2021.

- We sent 1,200 pieces of mail

- 6 people reached out to us

- We made offers on 3 homes

- We are on the cusp of signing one contract

Although this direct mail effort is in the nascent stages, I’m growing more and more impatient by the day.

Cold Calling / Texting:

I firmly believe you can increase the surface area of your luck by simply taking more action.

I was getting tired of waiting for my direct mail to turn into something, so I started cold-calling and texting rental listings on Zillow and Craigslist.

I’m trying to find a tired landlord sitting on a vacant unit.

It’s not a great process, but here’s what my cold outreach strategy looks like right now.

- Casually open Zillow / Craigslist whenever I’m bored

- Filter on Rentals

- Click through everything available in the markets I’m interested in

- Text (if iMessage) or call anything I’m interested in buying

- Follow up whenever I remember

Here’s a sample text thread that resulted in the desired property getting leased about a month after my initial outreach.

Most of my cold outreach ends with some form of “not interested”.

But this is sales. At the end of the day, it’s a numbers game. I just need to pour more leads into the top of the funnel and get used to rejection.

A Fish on the Hook

On Monday, April 26th, I reached out to the listing agent for a 3 bed / 2 bath rental. From the pictures, I could tell this unit was one-half of a 2-family home.

I went into my typical spiel and asked the agent if the homeowner would entertain a purchase offer.

To my surprise, the agent said yes, and he even provided a number: $510,000.

Wow! This shows motivation.

I couldn’t help but get a little excited. I asked to see the property.

We scheduled a walk-through for three days later on Thursday, April 29th at 11 am. I invited my business partner, Bill. In the meantime, we began to do our homework.

Based on the gross potential rent, condition of the property, and other market factors, we were ready to make the following offers:

- $455,000 cash with just an environmental and structural contingency.

- $470,000 if they allowed for a financing contingency as well.

- $485,000 if they could provide seller financing at favorable terms.

“Favorable Terms” is subjective. My current BATNA (best alternative to a negotiated agreement) on rental property financing is 4.25% fixed over 30 years with ~2 origination points.

This Seller is Motivated

When we arrived at the property, the Listing Agent (LA) showed us all of his cards.

LA: “The homeowner is going through a divorce and has to sell all of his properties.”

- I’m so sorry to hear that. What do you mean by all of his properties?

LA: “Well, they have another two properties in this town. One is a 3-family and the other is a 6-unit apartment building”.

- *I try hard not to show my excitement as I glance towards my business partner.* We’d love to see those properties as well. Anything else we should know?

LA: “They own a total of 50 properties. I think there are about 125 units in total...”

- *I lick my lips to make sure I’m not drooling* Where are these 50 properties?

LA: “Oh, you know. All over the place…”

The agent starts rattling off some of the best towns in Northeast NJ. Almost all of them have a train station that goes directly into NYC.

I can’t believe my luck... Or can I?

I’d be remiss if I didn’t take this opportunity to share my career goal for 2021: Acquire 55 More Rental Units.

I've written this sentence down every single day of this year: 66 total rental units by the end of 2021.

I’m currently at 11 units across 3 properties. 55 more puts me at 66 units total. With an average rental rate of $1,250 per month for 66 units, my gross potential rental income would be $1M / year.

Back to the story...

As we tour the property, Bill and I pepper the agent with as many questions as we can think of.

- What’s the timeline for liquidation?

- What’s the general condition of each property?

- Who is managing the portfolio?

- What’s the disposition strategy?

- What’s occupancy like?

- What are collections like?

- What are rents like?

- Do you have pictures?

- Do you have a list of the properties?

He answers everything to the best of his ability.

It seems like he’s being completely transparent with us. I’m not sure why, but I have a few hunches.

First, we provided proof of funds ($500K) to purchase the property we were visiting in cash so he knows we’re well funded.

Second, I sent him my investment track record alongside my proof of funds to let him know I’m active and have relevant experience.

Third, we asked the “right” questions by focusing on the big picture. We blew past the kitchen and bathroom on the first floor and went straight to the basement to see the mechanicals. From there we quickly toured the upstairs and asked if there was access to the attic to potentially check the condition of the roof.

Professional Problem Solver

3 of the 50 properties were already listed for sale on the MLS. The listing agent for these 3 properties was appointed by the court as a condition of the divorce settlement.

Now I understand why the agent I’m meeting with is being so forthcoming. He wants to represent me as a buyer because he can’t represent the owner as a seller.

This is unfortunate for him, but great for me. Apparently, the agent I’m meeting with sold a lot of these properties to the owner. So he has a personal relationship with the owners and also has in-depth knowledge of many of the properties in the portfolio.

The agent told me the expected timeframe to sell through all properties was 2-3 years. The court-appointed listing agent was going to list a handful of properties at a time until all of them were gone.

This seemed highly inefficient and incredibly risky for the sellers.

- Interest Rates are at historically low levels right now.

- Prices, which are inversely related to interest rates, are higher than ever.

- Buyers are fickle. Going under contract with the wrong buyer can waste 3 months.

- Transaction costs for 50 different transactions are prohibitive.

My proposed solution was making an offer on the portfolio. All I needed was the list of properties to present an offer.

Running the Numbers

After our property walk-through on Thursday, April 29th, I followed up with the agent to send me the list of all 50 properties.

At first, he hesitated. He wanted to see proof of funds. I couldn’t help but laugh.

I told him no one is sitting on that kind of money. If I decide to purchase this portfolio, we’ll have to raise the money and find a lender willing to take on the debt. It won’t be easy, but it’s possible.

Thankfully, he understood. The list hit my inbox a few hours later.

If I’m being honest, I had no idea how to underwrite this opportunity. I opened a new Google Sheet and started piecing the information together.

I combined Actuals, Assumptions, and Calculations to get to an offer price.

- Property # (1 - 50)

- Street Address

- Town

- Unit Count

- Gross Potential Rent

- Vacancy

- Property Management Fee

- Repairs & Maintenance

- Capital Expenditures

- Property Tax Actual

- Insurance

- Utility

- Net Operating Income

- Value-based on9:30 pm 7% Capitalization Rate

- Value-based on 6% Capitalization Rate

- Value-based on 5% Capitalization Rate

- Last Sold Date

- Last Sold $ Amount

I made the following assumptions:

- Vacancy: 6%

- Property Management: 4%

- Repairs & Maintenance: 5%

- Capital Expenditures: 5%

- Insurance: $125 per unit per month

- Utility: $50 per unit per month (common area only)

When I looked up each property in public records, I had access to:

- Square Footage

- Property Tax Amount

- The Last Sold Date

- Last Sold $ Amount

I took note of the Last Sold $ Amount because I wanted to know the current owner’s cost basis.

They’d been buying property since the mid-’80s. I doubt they were going to let go of this portfolio for less than they were into it for.

Based on my research, the current owner’s purchased all of these properties for a total of ~$17.7M.

With a Net Operating Income of 92K per month, a 6.2% Capitalization Rate gets us to the current owners’ cost-basis of 17.7M. Not bad.

Luckily for us, we can afford to go higher in this market.

Based on the Current Gross Potential Rent of $195K per month, I’d be happy to acquire this portfolio for closer to $20M.

If I’m willing to move down to a 5% cap rate, I can move up to an offer of $22M.

Definition: Capitalization Rate

Let’s take a second to define Cap Rate. In its simplest form, the cap rate is the return you can expect if you pay for a property with cash.

Cap Rate = NOI / Purchase Price

If a $100,000 property has an 8% Cap Rate, you can expect to make $8,000 per year in cash flow if you don’t use any debt to buy the property.

Investors use cap rates on commercial properties to determine their purchase price. So let’s say an asset generates $10,000 per year in income and you want to achieve an 8% cap rate, your offer would be $125,000 ($10,000 / 8%).

Cap Rates generally don’t apply to residential properties (SFR, 2-4 units, Condos, & Townhomes). But when you’re looking at buying 50 residential properties, it makes sense to value the portfolio on an income basis as opposed to the sum of its individual parts.

Luckily for me, in this instance, using the income-based valuation approach will yield a lower purchase price than a comparable sales-based approach, which means I can buy the package low and sell for parts high.

It’s like the guy who buys a 48 pack of water bottles for $4.99 from Costco and sells them on street for $1 each. Except...with houses.

Back to the story...

Opening Offer

By Friday, April 30th, one day after our walk-through, we made it clear we were going to make an offer on the entire portfolio.

We took the weekend to run our numbers and sharpen our pencils. On Monday, May 3rd, we found out the sellers did their homework as well.

🤯🤯 Twenty Nine Million, Seven Hundred Fifty Thousand Dollars 🤯🤯

We’re almost $8M apart.

How do you submit a counteroffer that’s $8M lower than asking?

Well, you don’t.

Going off on a Tangent

Instead of responding to their portfolio offer, we decide to go off on a tangent.

On Monday, May 3rd, we made an offer of $3.105M for 4 properties:

- Duplex

- Triplex

- Two 6-unit Apartment Buildings

Why do this?

It’s simple. We aren’t willing to meet their $29.750M number for the portfolio.

Instead of coming back with what will surely be seen as a “low-ball” counter and risk upsetting the seller, we steer the conversation in a different direction.

We’re hoping to accomplish a few things with this new offer:

- Lock up the only two apartment buildings in the portfolio (6 units)

- Capture some retail value with the duplex and triplex

- Get our foot in the door at a low $ / door valuation & then extrapolate

$3.105M / 17 units = $180K per door. If we can close on these 17 units at this price, there will be nothing logically stopping us from extrapolating that price per door to the rest of the portfolio.

The duplex and triplex will trade on the open market for closer to $250 - $275K / door. If we can capture that delta across 5 units, that’s a gross profit of up to $95K / door or $475K in total.

Let’s assume we can net $400K across the duplex and triplex after selling costs. We’d then use that money towards the purchase money for the two 6 unit buildings.

At $180K per door, the two 6 units would have a cost basis of $2.16M (12 * $180K).

25% down on $2.16M would be $540K.

$540K - $400K = $140K to get into 12 units, which are probably actually worth ~$2.4M.

(140K / 2.4M) = 5% Down. A friggen steal.

Their Counter

It took the sellers one day to counter at $3.8M! They even gave us a price breakdown per property.

Now we’re in the game. Here’s the email from our buy-side agent.

Here’s how our offer stacks up against their counter:

We came in at 182K per door and they countered at 225K per door. I’m not surprised by their ask.

I was, however, surprised by the little gift at the end of the email. Did you catch it? “5% less if your client buys all four.”

Hilarious. We made an offer for 4 properties and they’re incentivizing us to buy all 4.

What does this mean?

They are willing and able to reward bulk activity. This is a key piece of information.

With their 5% discount, their 3.8 counter comes down to 3.61 or $212K per door.

We’re making progress, but we’re not satisfied yet.

Walk The Remaining Properties

We made an offer on 4 properties, but only saw one.

We scheduled a walk-through of basements and attics of the other 3 properties with our agent for Wednesday, May 5th at 3 pm.

During the walk-through, we asked more questions about the seller’s condition, motivation, and general outlook on this entire process.

Information is more valuable than money when negotiating. Whoever talks less and listens more is usually coming away with an advantage.

Before we left our agent that day we mentioned the price as a mere triviality.

“We’re looking forward to doing business together. I’m sure we’ll come to terms. The sellers seem like they’re in a rush to sell off the portfolio. That 5% discount for the 4 property package is pretty telling. We want to help them out of this tough situation, and we feel like we made a fair offer. After seeing the condition of the properties, maybe we can come up a little bit. Let us go back to the drawing board with what we know now, and we’ll get back to you

tomorrow.”

Surprise Email

After our walk-through of the 4 properties, we told our agent we would get back to him tomorrow about our ability to come up in price.

He must have talked to the sellers’ agent because we received an email from him later that same day.

This email is packed with information, signs, and tells.

- Sent at 9:30 pm (as opposed to scheduled for 9:00 am). *Urgent*

- $3.4M for 4 properties. Another discount without formally asking for one.

- They went from 3.8 → 3.6 → 3.4 without us saying a word.

- Portfolio price reduced from 29.75M → 26.4M, but 2 properties removed. (3.35M reduction)

First Counter:

We decide to defer the portfolio play and stick to our guns on the 4 property package.

It took us a full day to craft our counter, but I’m happy where we landed. Here’s the email we sent.

We came up in price by $120,000, or $7K per door (3.105M → 3.225M)

However, and this is important, we provide them the opportunity to almost achieve their number. They wanted 3.4M. We agree to give them 3.35M if they can deliver all 17 units vacant.

This is a tall order. We’re almost certain they won’t be able to do it. But the gesture/willingness to meet their number is on the table as a tit-for-tat transaction.

We finish with agreeing to their Earnest Money Deposit Schedule with a slight twist.

They wanted a $50,000 deposit to go hard upon signing the contract. We countered with a 1% (market-rate) EMD that becomes non-refundable after due diligence.

We also agreed to bump up the deposit to 10% once we’re out of Attorney Review.

Finally, no financing contingency. If we have to beg, borrow, or steal the money, we have to obtain financing to complete this purchase or they’re within their rights to kill the deal and keep our EMD.

Next Steps:

I’m excited to see where this opportunity takes us. On one hand, it could be a complete dud. On the other hand, it could be the biggest move in my young career.

After learning about this opportunity, I had a slight case of imposter syndrome. If I’m being honest, I didn’t think we’d ever get this far in the discussion of trying to acquire a 50 property / 125 unit portfolio.

I started documenting what was happening on Monday or Tuesday of this past week because I thought the story, even if it ended badly, would be cool to tell.

I’m glad I did because things are moving along nicely. And if this all goes well, it’ll be awesome to look back on how it all happened.

If you made it to the end of this post and are interested in learning more about investing in this opportunity, click here to schedule 30 minutes with me.