I still haven't found the right video editor.

I did record a video this week but the final cut won't be available until tomorrow at the earliest. #fail

So let's kick it old school and make this week's newsletter written word only.

Livin La Vida Luna

Accessories galore. Peacocking at its finest.

Is Renting a Waste of Money?

Dia and I are looking to move to a new apartment next month so I thought now would be a good time to answer the age-old question of “Is Renting a Waste of Money?”

I’m going to do my best to answer the question by simply comparing the costs of homeownership to the costs of renting.

Alright, let’s dive in!

Comparing Costs Only:

The first thing I want to say is we will ONLY be comparing costs.

By that, I mean money that is spent and will never come back.

Obviously when you own a home, part of your monthly payment goes to the principal, and you can recover that equity when you sell or refinance.

Costs of Renting:

Let’s start with the cost of renting because it’s simpler to calculate.

I’m going to use our actual numbers to illustrate the example better.

In our current situation, There are 4 main costs to renting:

- 💸 - Rent

- 🗑 - Other

- 🎟 - Fees

- 🥷🏽 - Insurance

💸 - Rent

The first cost is obviously the rental rate. We pay $2,755 per month in rent. We live in a 2 bed, 2 bath 1,200 square foot corner unit on the top floor of our building so we pay a little over $2 per square foot.

🗑 - Other

We also pay $27 per month for valet trash and pest control services. This is kind of cool and annoying. We can leave our trash outside our door at night and someone will come to pick it up. But the trash chute is on our way out of the building so I’d much rather save this money and take the trash out myself.

🎟 - Fees

The third cost is upfront fees associated with renting. We paid $60 in admin fees and $525 in amenity fees for the entire lease term, which comes out to just over $40 per month. Our building has all the bells and whistles. There’s a gym, a pool, a club room to host parties, multiple offices for people to work from home, a dog park, and a bunch of other cool stuff most homes don’t have.

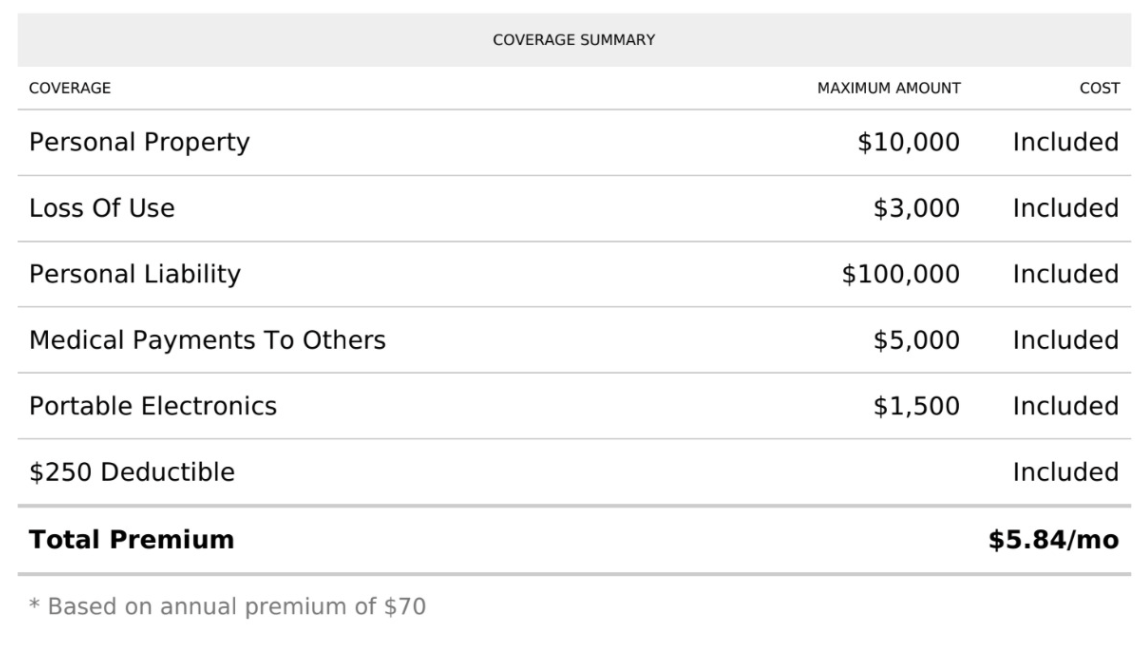

🥷🏽 - Insurance

The third cost is renter’s insurance. We paid $70 for the year which comes to just under $6 per month.

So when you add it all up, our total monthly cost to rent is $2,829.

- $2,755 - Rent

- $27 - Valet Trash & Pest Control

- $41 - Amenity + Admin Fee

- $6 - Renter’s Insurance

I’m not going to include utilities because that cost exists in both situations.

Costs of Buying:

Now let’s move over to the buy-side of the equation.

On this side, we have 5 different costs to account for.

- 🏡- Mortgage interest

- 🧾 - Property taxes

- 🛠 - Maintenance

- 🥷🏽 - Home-owners insurance

- 💰 - Opportunity Cost

Now to calculate these costs, we need to have a subject property. I’m going to use a home Dia and I can actually see ourselves buying. It’s not ridiculously overpriced for our market and it’s close to where we live now. It’s also not brand new and it’s in a community with decent amenities.

This townhome is listed for $610,000.

🏡 - Mortgage interest

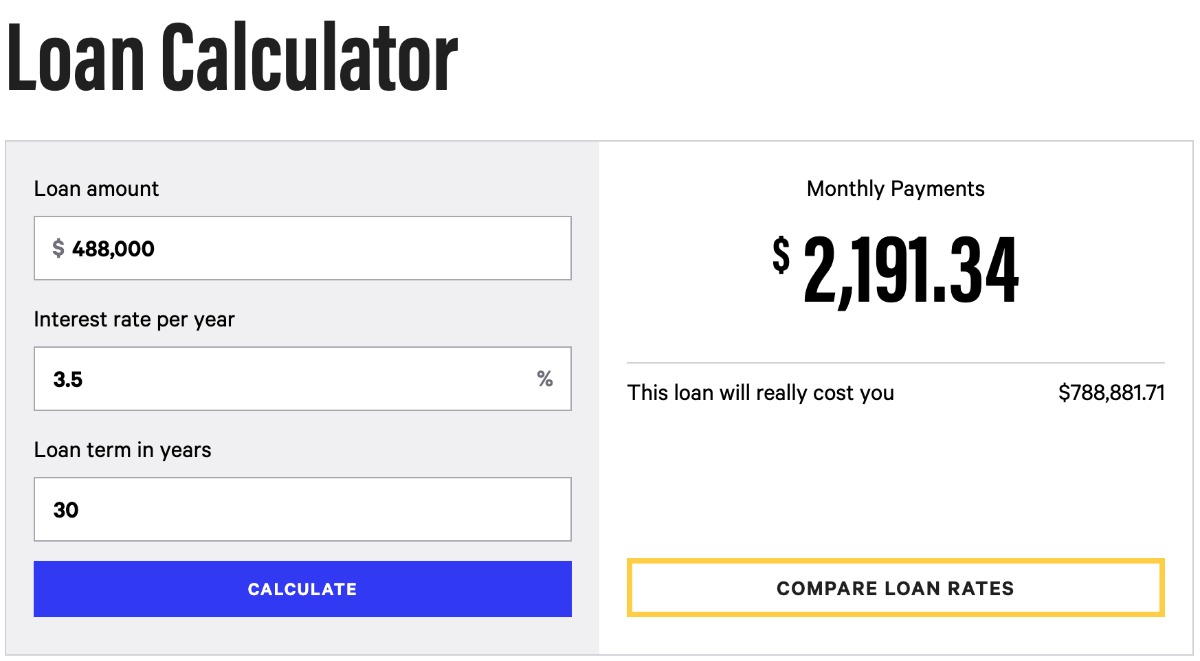

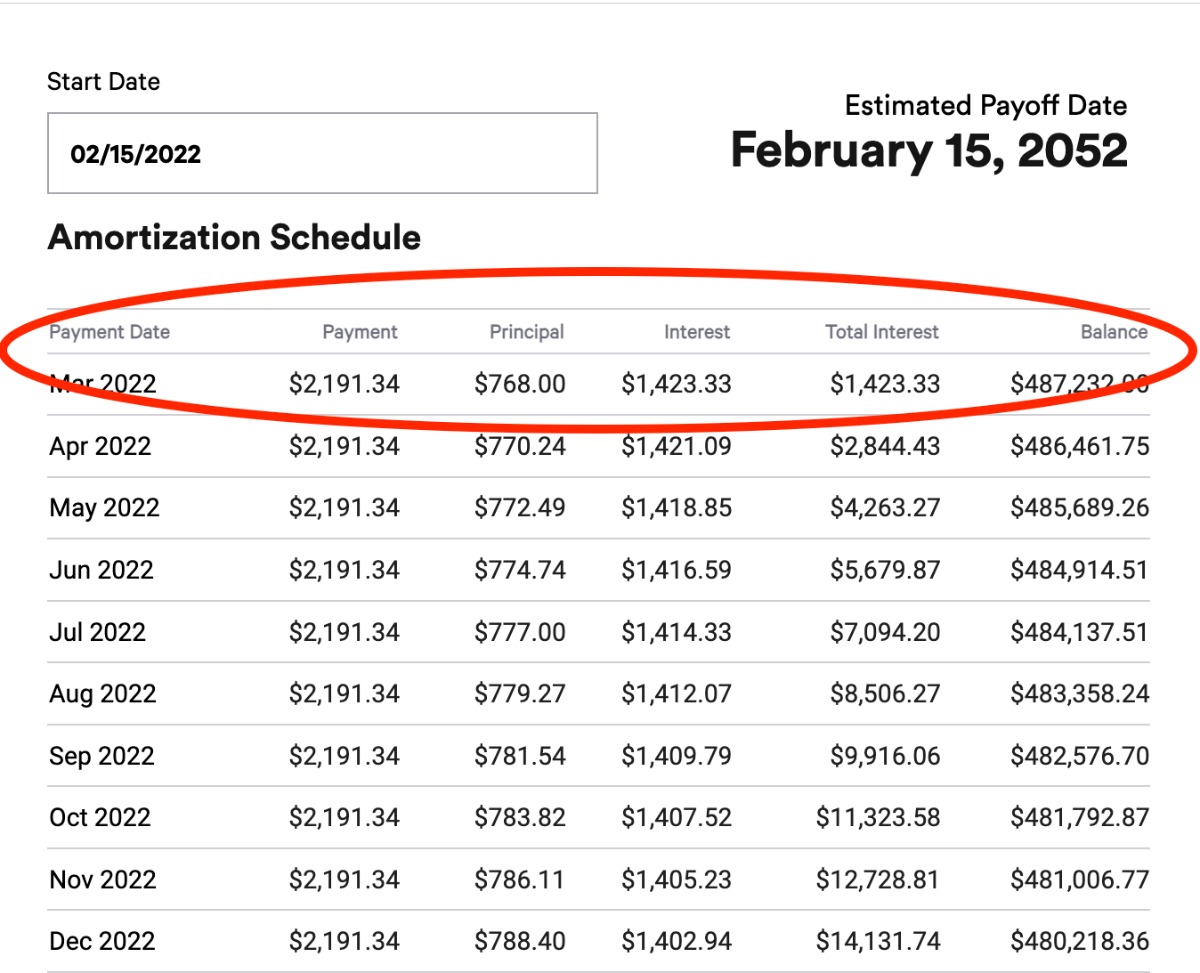

Let’s assume we put 20% down and got a fixed-rate mortgage at 3.5%.

Our monthly payment on a $488,000 loan would be $2,191.

As you can see this $488k loan will actually cost us $788k over 30 years.

So we’re basically paying an extra $300k for the property in interest alone.

Let’s say best-case scenario we stay the entire 30 years.

Our interest cost would be $833 per month.

- $300,000 / 30 years / 12 months = $833 per month.

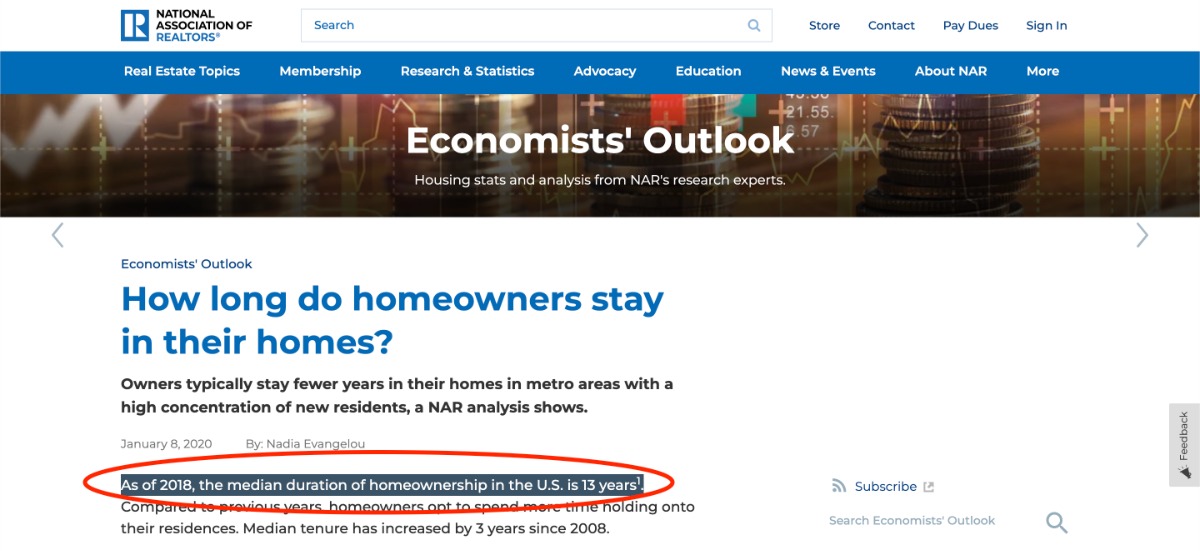

According to the National Association of Realtors, the median duration of homeownership in the U.S. is 13 years.

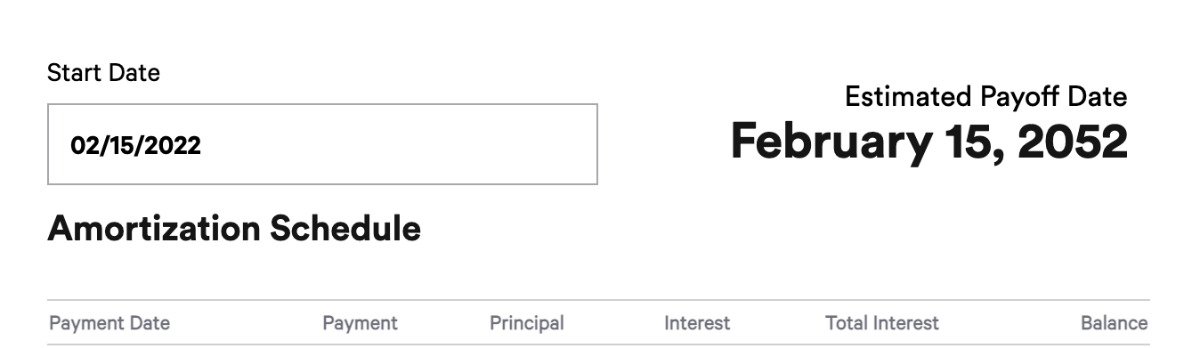

This is crazy because if you look at the amortization table for this particular loan with a competitive interest rate, you’ll realize the first 10 years of monthly payments are mostly interest. It’s not until 10 years and 3 months that the principal portion of the monthly payment exceeds the interest payment.

So if you sell your property within 10 years, your monthly payment would have gone mostly to interest, which is usually the highest irrecoverable cost of homeownership.

To drive this point home, look at the first few months of loan payments, the interest portion is almost double that of the principal portion.

🧾 - Property taxes

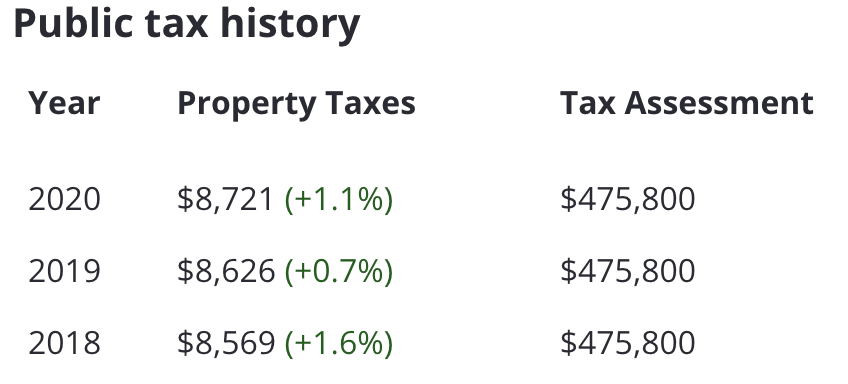

The next cost associated with this townhome is property taxes.

According to Zillow, the property taxes here are $8,700 per year or $725 per month.

🛠 - Maintenance

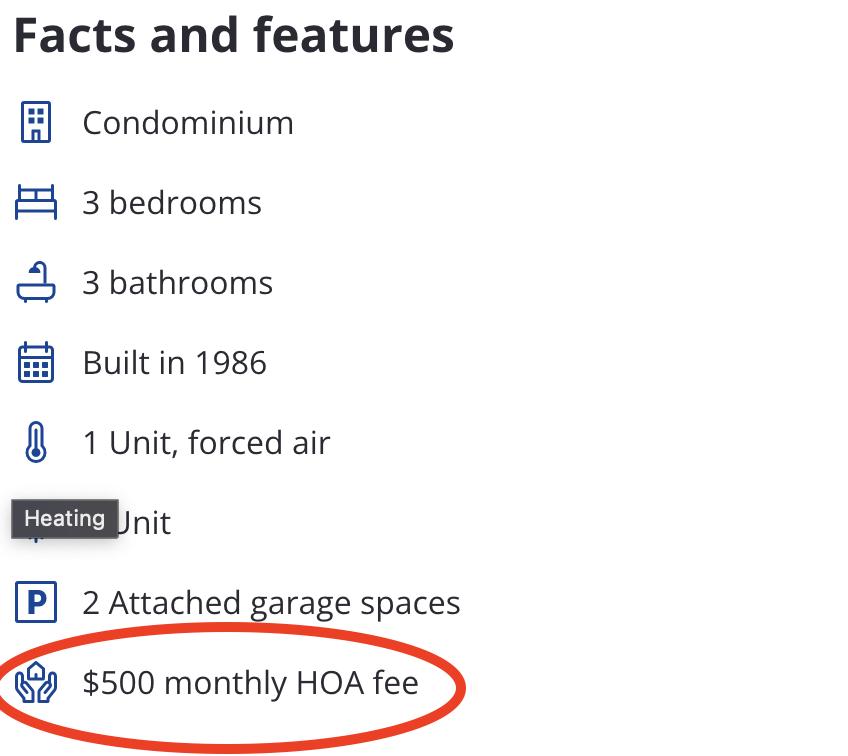

Since this is a townhome, there are Homeowner’s Association dues. According to the listing, those come out to $500 per month.

HOA fees typically cover the costs of maintaining common areas, such as lobbies, patios, landscaping, swimming pools, tennis courts, a community clubhouse, and elevators. In many cases, the fees cover some common utilities, such as water/sewer fees and garbage disposal. In this community, the HOA also covers roofing and siding, but not windows.

Since most of the exterior maintenance is covered I’m only going to budget an extra $100 per month for interior maintenance. That will essentially cover replacing all major appliances every couple of years, the occasional paint job, and updating fixtures over time.

That brings our total monthly maintenance costs up to $600.

🥷🏽 - Home-owners insurance

The fourth major cost is homeowner’s insurance.

Townhomes and condos are typically less expensive than single-family homes so I’d budget about $150 per month to ensure this property.

We have a few friends and family members that live in similar style homes and I know this jives with what they’re paying.

💰 - Opportunity Cost

The final line item I want to mention is the one I think people tend to forget about. Or maybe they don’t forget about it, but they’re just OK with not counting it. And that’s the opportunity cost on a down payment.

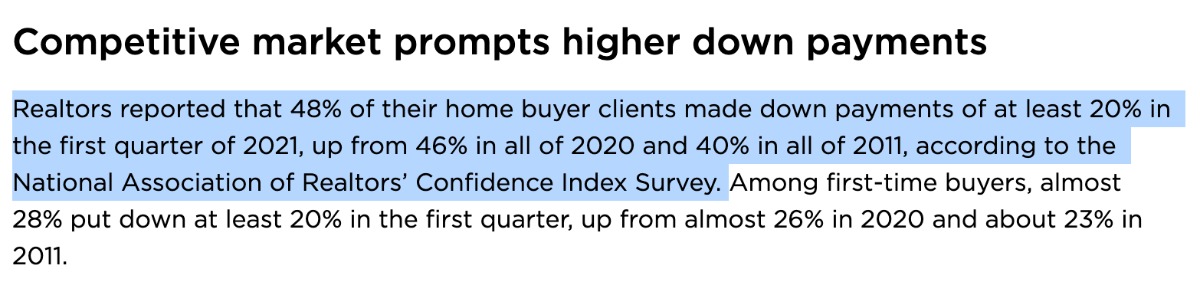

When you buy a home, you have to bring some equity to the table. Usually, that’s in the form of a 20% down payment. There are obviously low money down loans out there and there are also people who pay straight cash for properties, but according to the National Association of Realtors, almost 50% of people are still putting 20% down because the market has been so competitive.

So for this particular property, a 20% down payment comes out to $122,000.

- $610,000 * 20% = $122,000.

Whenever I send my money out, I’m expecting a minimum return of 8%.

8% on $122,000 is $9,760 per year that I’m potentially giving up in investment income.

Now we also have to assume that the value of the property will go up by something like 1% per year, which in this case is $6,100.

This gain is a direct offset to the opportunity cost and the delta there is about $3,600 per year or $300 per month.

- $9,760 - $6,100 = $3,660 or $300 per month.

When you add it all up, our total monthly cost to own this particular home is is $2,608.

- $833 - Mortgage Interest

- $725 - Property Taxes

- $600 - HOA & Maintenance

- $150 - Insurance

- $300 - Opportunity Cost

🧐 Final Thoughts

If we compare the two, the monthly cost of homeownership is about $220 less than the monthly cost of renting.

- $2,608 - Monthly Cost To Own

- $2,829 - Monthly Cost to Rent

- ($221) - Variance

Back when Dia and I were DINKs (Dual Income No Kids) and our rent was a little less expensive, the flexibility and lack of responsibility around renting made more sense to us even though the costs were similar.

I was willing to pay a premium to rent to not have to worry about anything. If something in our apartment stopped working, we’d send one email and it would be fixed less than 24 hours later at no additional cost to us.

One of my invisible scripts holding me back from buying a primary home is I don’t want to deal with regular or sporadic maintenance issues whether it’s mowing the lawn or shoveling the snow to replacing a light bulb or fixing a dishwasher.

But now that we have a toddler and one more on the way, I’m warming up to the idea of owning a primary home simply because we’re entering that season of life.

It’s starting to become less about what makes more financial sense and more about what makes us happier as a family.

I’ve said this before, but now I’m willing to put some money on it. Barring some crazy unforeseen circumstance, this next lease term will be the last time we rent where we live. Sometime between now and 2023, we will put down roots by buying our first primary home.