When we finally made the decision to close our franchise restaurant in October 2017, we started to assess potential damages. I knew we weren’t going to be able to just lock the doors and walk away unscathed. We had to perform damage control.

I had to negotiate my way out of a lot of service contracts that were set to expire after our closing date.

Some vendors were harder to convince than others. Our cable/phone/internet company dug their heels in. Then I reminded them my immediate family and I have multiple other [business and personal] accounts with them.

We paid our bookkeeping & payroll service in advance until the end of the year. That ended up being a sunk cost I couldn’t recover.

I remember the music service we used being extremely difficult to negotiate with. They ended up sending the bill to a collections agency. The collections agency was easy to deal with. One email with proof we closed made them go away.

In the end, we cut ties with all vendors without burning bridges or feeling ripped off.

The last person I called before closing the store was the landlord. Thankfully, I didn’t sign a personal guarantee on the lease.

The landlord couldn’t come after our personal assets for rent money. Since the company was being dissolved and liquidated, he had no claim. Easy enough.

When I told him we’d be closing down, he wasn’t too surprised. When I told him I never signed a personal guarantee, he almost lost his mind. “How did you not sign a personal guarantee? We make everyone sign that.”

When we negotiated the terms of the lease back in 2013, everyone (broker, landlord, & franchisor) focused on the rate ($ / square foot), term (# of years), and escalation (% increase per year). One of my mentors advised me to concede on any of those three items as long as I didn’t have to sign a personal guarantee.

If I had signed the guarantee, I’d have to pay the rent out of my pocket even if we went out of business. Our rent was around $4,000 per month for that space. Dodged a bullet.

I did sign a personal guarantee somewhere else though.

??The Franchise Agreement

A franchise agreement outlines the terms between the franchisee and the franchisor. It details each party’s obligations and what happens in the event of default.

One obligation from the franchise agreement is the royalty fee. We had to pay the franchisor a royalty fee on a weekly basis. The fee was a percent of sales calculated by our point of sale system. The franchisor pulled that amount via ACH from our bank account every Monday for the prior week.

The term for the franchise agreement was 10 years. We only operated for three. Meaning we were about to default on seven years of royalty payments.

The franchisors calculated the net present value of seven years of royalty payments to be $60,449.91. I’ll get to how I found out that number in a second.

But first, a lesson from the School of Hard Knocks.

??It’s Not Personal, It’s Business

We were in this franchise system for four years. One year of development and three years of operations. We knew everyone in the franchisor’s corporate office from the CEO to the interns.

Despite the business under-performing, we had a good relationship with the people. Mostly because they at least pretended to care.

When I called the CEO to let him know we’d be shutting down, his response surprised me.

“If you close the store, we’ll have no choice but to demand payment for the royalties owed for the remainder of the franchise agreement”.

Wait, what? I was confused.

We were struggling for 3 years. At no point did we do well. We knew it, they knew it. We tried to solve the problem together.

Countless hours on the phone to discuss strategy. Countless training sessions to learn how to better serve our customers. We aren’t failing for a lack of effort. Why are we being punished? Can’t they let it slide?

“If I don’t take action against you, it would set a bad precedent. I’m terribly sorry it didn’t work out, but you’ll hear from our lawyers”.

Fuck.

?Getting Educated

My first move was to contact the other franchisees I already knew. I wanted to tell them about how the company did me dirty. I also wanted to see if they had the contact information of any other franchisees who closed. I had a few phone numbers, but I acquired more through my network.

I wrote down a dozen questions and started dialing. Half the people never answered. Half of the remaining were reluctant to talk to me. They didn’t want to relive the bad memories, which I understood.

Two guys answered all of my questions and ultimately started calling me to follow up on my case. From these two guys, I learned what to expect in the coming months.

First, the Franchisor would send “Demand For Payment” letters. These were formal requests for me to pay what I owed. These letters looked scarier than they were. They were full of legalese and came in envelopes that required my personal signature for delivery.

Each letter said the same thing. I’m in breach of contract. I owe them a ton of money. If I fail to reply, the franchisor was going to file a petition against me in the state of Texas.

I didn’t reply.

The two guys that took my calls helped me remain calm. One of them was counter-suing the franchisor. He asked if I wanted to join him, but I respectfully declined. I wanted to get out of the fight, not go another 12 rounds.

After two demand letters in January, nothing happened in February. In March, they sent a “Final Demand Letter”. If I didn’t reply in 30 days or less, they’d move forward with filing a lawsuit against me.

Still didn’t reply. This was a game of chicken I couldn’t afford to lose.

I prepared myself to hire a lawyer in Texas to plead my case. It would be costly and if I lost, I’d have to pay Attorney’s Fees for both sides.

I took a course in Negotiation Strategy in college, but I knew I was about to enter the biggest monetary negotiation of my life. To sharpen my axe, I bought a book called, Never Split The Difference: Negotiating as if Your Life Depended on it.

This book was a crash course that ended up generating a ~2,500x Return on Investment. I’ll share how throughout the course of the story.

I didn’t receive any letters or notices from the franchisor in April or May. In the middle of June…

?The Phone Rang

It was the CEO of the franchise. The conversation went something like this.

“Hey Sunny, we’re getting ready to file a petition against you early next week. I just wanted you to hear it from me first”.

- I appreciate you calling so I could hear it from you first. I wish you didn’t have to do this. We really tried to make it work.

“I wish we didn’t either, but you haven’t been replying to our letters. If you want to settle this before it goes to court, the company is willing to discount the claim amount by 50%. You’d only owe about 30K. How does that sound?”

- It seems like you want to settle this quickly. But how can I pay 30K? If I had that much money, I would still be in business trying to make the restaurant work. How else can we solve this problem?

“Well what would you be comfortable with?”

- I’d be comfortable if this all went away. Like I said, I put all of my resources into this business and it didn’t work. How do you feel about dropping this altogether?

“Unfortunately, we can’t drop this. If you want to think about it, my offer stands until the end of the week.”

That call was the last time I ever talked to anyone who worked at the franchise company. From this point on, we’d be conversing through lawyers.

That call was also the first opportunity I had to implement lessons from Never Split The Difference.

Lesson 1 – Mirroring:

Imitation is the highest form of flattery. One trick top negotiators use is repeating what the other person says. The first thing I said was echoing the last few words the CEO said to me.

Lesson 2 – Labeling:

Validating someone’s emotion by acknowledging it. Spot their emotion and turn it into words. When he made his first concession offer, I labeled it by saying, “It seems like you want to settle this quickly. He did not deny it, so I assumed it was true.

Lesson 3 – Use Calibrated Questions:

Avoid verbs or words like, “can”, “is”, “are”, “do”, or “does”. Start your questions with words like “what” “how” and sometimes “why”. I asked two calibrated questions. Only one of them worked.

- How else can we solve this problem?

- How do you feel about dropping this altogether?

Lesson 4 – Say No Without Saying No:

Instead of saying no to his 30K offer, I asked How can I pay 30K?

At this point it seems like I was losing. I asked myself all week if I should take their offer. The fact remained, I couldn’t afford it. So taking it wasn’t an option. We’d go to court.

?You’ve Been Served

Getting sued sucks. Their side hired a courier service to track me down and meet me to deliver the lawsuit. They called me to schedule a drop-off time. In case I missed it, they start listing all the other ways they knew how to find me. It’s really hard to avoid them. So I didn’t try.

I received my docs on June 22nd, which meant I had until July 16th to file an answer (15 business days). Once I was served, I called the lawyer my new friend was using to counter-sue the franchisor.

I had to sign an engagement letter and send a retainer for $5,000. After doing that, I told the lawyer to file an answer no sooner than the morning of July 16th.

Lesson 5 – Time is Your Friend

Allow the maximum available time to pass before making a move.

“Going too fast is one of the mistakes all negotiators are prone to making. If we’re too much in a hurry, people can feel like they’re not being heard. Passage of time is one of the most important tools for a negotiator.”

?Trial Date Set

After filing our answer on July 16th, we received an update from the court on August 6th. Our Trial Date would be April 22, 2019. This was excellent news. It would be 9 months until I’d be required to do anything else.

Their side didn’t waste any time. On August 21st, the franchisor’s counsel reached out to see if I’d like to mediate this case by the end of 2018.

For mediation to occur, I’d have to go to Dallas, TX and sit in a private meeting with the people suing me. I was able to keep my shit together sitting at my desk editing my thoughts on a keyboard.

If I was in the same room as the people who were suing me after I lost everything, I might just lose my cool. Mediation wasn’t going to work in my favor. I declined. Instead…

??Time To Roll Up The Sleeves

I asked my attorney to make my first offer: $2,500 towards plaintiff’s attorney fees. This allowed their side to walk away without having incurred too many costs. I’m so kind.

They countered immediately at $12,000. $2,000 up front and $10,000 paid monthly over 1 year. Another 50% drop in their settlement offer. Damn these guys are desperate.

A few days later, I asked my Attorney to counter with the balance of my retainer account, which at the time had gone down to $4,200.

They countered immediately again: $8,000.

My attorney begged me to take it. Each counter cost me at least $150 in attorney’s fees. My lawyer charged $300 per hour.

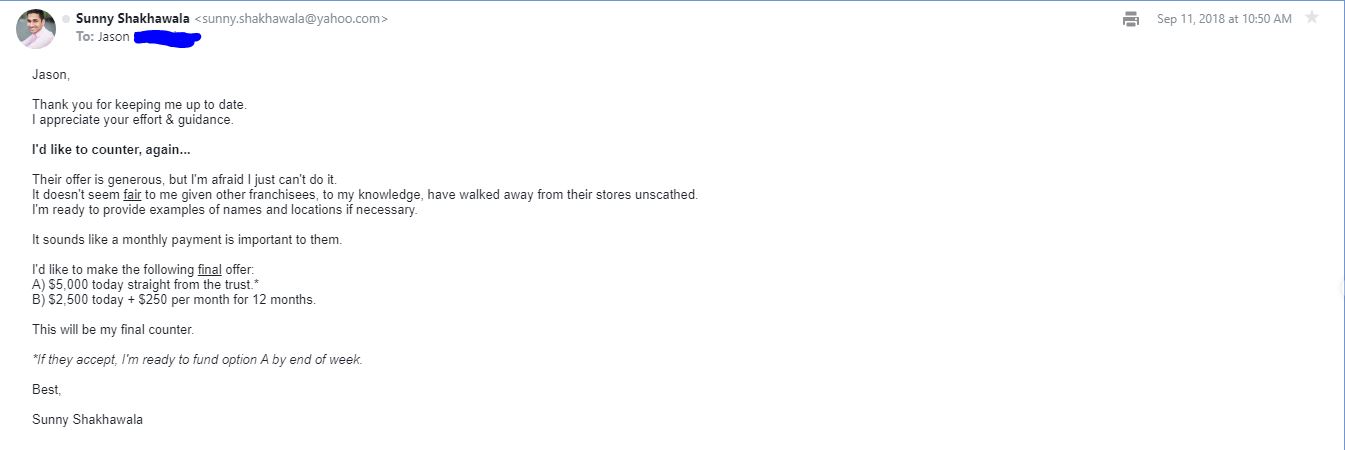

I told him I don’t have it. The only money I had was what I gave him as a retainer. We had to settle this with what remained. So I countered again. This time with options.

Here’s an image of the email I sent my attorney before my final offer was accepted.

I used the following lessons from Never Split The Difference in my final offer.

Lesson 6 – The F-Word:

The most powerful word in negotiation is “Fair”. The most common use is a judo-like defensive move that destabilizes the other side: “We just want what’s fair.”

Lesson 7 – Never Compromise:

No deal is better than a bad deal. I made it clear this would be my final counter offer.

Lesson 8 – Guarantee Execution

“Yes” is nothing without “How”. While an agreement is nice, a contract is better, and a signed check is best. I ended my offer with, “*If they accept, I’m ready to fund option A by the end of the week.”

Lesson 9 – Ackerman Bargaining Method

- Set your target price (goal)

- My goal was $5,000 total including Attorney Fees

- Set your first offer at 65% of your target price

- My first offer was $2,500

- Calculate 3 raises of decreasing increments (to 85, 95, 100% of goal)

- My 2nd offer was $4,200.

- Use lots of empathy and different ways of saying “no” to get the other side to counter before you increase your offer.

- I wasn’t able to do this effectively because we communicated through lawyers.

- Make them bid against themselves

- I did this early on to get the first 50% discount.

- When calculating the final amount, use precise, non round numbers like 37,984, rather than 38,000.

- I didn’t do this.

- On your final number, throw in a non monetary item (that they probably don’t want) to show you’re at your limit.

- I offered two options. Full payment now vs. half now and half over time.

The End

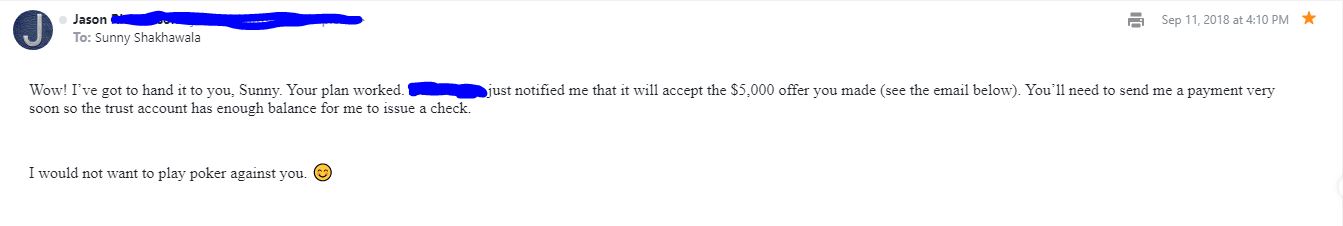

For what it’s worth, here’s an image of my attorney’s reply. He seemed to be “impressed” by my tactics. I spent about an hour wondering if I could have done better. Then I realized this whole situation is now 100% behind me. That alone was worth the settlement cost.

In the end, we went from $60,000 down to $5,000 + my attorney’s fees which came to about $1,500.

I owe a lot of credit to a book that cost $20…

$53,500 / $20 = 2,675x return on my investment.

Pretty freaking good.

Thanks, Chris Voss.

—

If you want to ever open your own restaurant, click here.

SUBSCRIBE NOW TOSUNSHAKSUNDAY

Join my newsletter if you want to learn more about real estate investing, personal finance, health & fitness, and so much more.