Livin' La Vida Luna y Luca

This pic is from 2 Sundays ago, when we had uncommonly good weather for October.

Kids are so funny when you ask them what flavor of ice cream they want. If they can't see it, they'll say vanilla or chocolate. If they can see it, they'll be like "Pink and Blue! Pink and Blue!" with absolutely no regard for what the actual flavor is. Guess which kid asked to be picked up to see into the freezer?

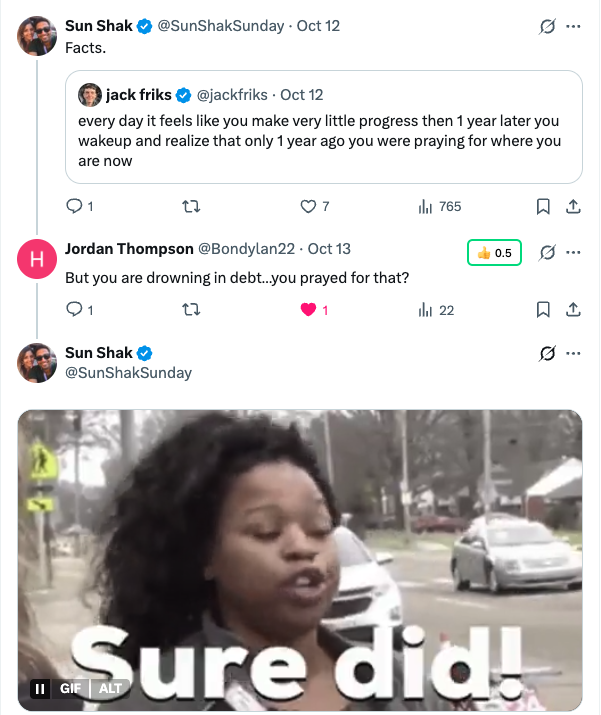

Got Myself a Troll

2 weeks ago, this random guy posted a snide and presumptuous reply on one of my tweets.

I played into it by posting a .gif of a falling house of cards.

A few days later, he showed up again. An annoying pebble in my shoe.

Again, I tried to be funny and brush it off.

K, now I understand what the H in his thumbnail stands for: HATERRR!!!

Bro!!! If you're gonna bring racial stereotypes into it, call me stinky, hairy, or cheap. I have been (or still am) all 3.

But Scammer? Miss me with that.

Why Give This Attention?

I'm not exactly sure why I decided to write about this particular topic. Maybe I'm channeling my inner Kevin Durant by shining a light on this Twitter cockroach.

Or maybe, just maybe, I feel the need to share my side of the story.

He's right about why I post on X. It is mainly a digital business card that generates potential investor leads for my development business.

And guess what? It works! I've converted multiple relationships built on X into friendships in real life, and after some time, a few of those people have invested in my projects.

I'm not, however, on the verge of bankruptcy or participating in a "slim margin business". More on this in a bit.

As far as drowning in debt... I kind of am, but I'm also not. It's tough to describe my relationship with debt, but let me try.

From a personal finance perspective, I hate debt. I respect it. I fear it. I don't want anything to do with it, really. I've never missed a payment, carried a balance on a credit card, or found myself underwater on anything...ever.

Case in point - here's all 4 of our personal credit cards (we really only use 2). We are carrying a negative balance of $1,000. Don't ask me how that happens.

But from a business perspective, I carefully use (a lot of) debt to fund our projects.

I don't think I've ever shared this level of financial detail about my development business with anyone outside my accountability group. It's actually kind of scary to show my cards like this... which is exactly why I want to do it.

Because one of my favorite quotes by author Neil Gaiman is:

“The moment that you feel, just possibly, you are walking down the street naked, exposing too much of your heart and your mind, and what exists on the inside, showing too much of yourself...That is the moment, you might be starting to get it right.”

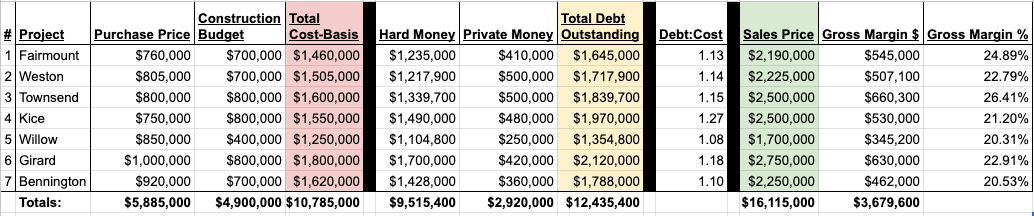

I'm currently doing 7 new construction (or heavy development) projects that are 100% financed by debt. Total debt outstanding is $12,435,400.00. Almost $3M of that is from private money lenders. These are regular people with excess capital looking to generate more yield than their best alternative.

$12.5M is objectively a lot of debt. Total After Repair Value of these projects is $16,115,000. And these are my estimates. The bank appraised most, if not all, of these projects higher than our underwriting.

With that said, the market would need to pull back roughly 30% for these projects to come out flat.

Another thing worth mentioning: ~25% of total sales are getting booked in the next 30 days. And we'll pay down ~27% of total debt when it does.

You'll also notice I take on slightly more debt for each project than it costs. My current average debt:cost-basis ratio is 1.15, meaning I borrow $1.15 for every $1 of expected spend.

I do this for one main reason: we need to borrow enough money to get to the first draw, which costs a little over $100,000 between architects, engineers, permits, demo, excavation, foundation, and carrying costs.

Sooo... why do so many projects, which in turn means taking on so much debt?

Well, I guess I could use my own money and do one, maybe two, deals at a time. But that also sounds like the perfect way to die from boredom.

My business model is two-fold: develop luxury homes in top-tier markets while generating consistent double-digit fixed returns for my investors.

One hand washes the other. I'm just the soap in this equation.

I can totally see how all of this seems risky. And I know people like to think entrepreneurs are risk-on by default. But it's actually quite the opposite.

My partners and I have carefully selected a narrow market to participate in, and we choose to sell to an even narrower buyer pool. Both of which are much stronger than the rest of the market in general.

We are obsessed with protecting margin, and the first question we ask ourselves after plugging in the numbers for each deal analysis is: "What's our breakeven number?"

We take Warren Buffet's First Two Rules of Investing very seriously:

- Rule #1: Never lose money

- Rule #2: See Rule #1

Final word on this topic: I'm vehemently against personal debt. Dia and I are making a conscious effort to pay off our primary home in the next 5 years after taking an interest-only mortgage to keep our monthly burn as low as possible. At the same time, taking on (business) debt to predictably generate an income for myself, returns for my investors, and build baller ass homes for families to enjoy for decades to come just seems like the morally responsible thing to do.

Before I sign off, I want to share one more comment from my alleged hater.

Dia moved to the US in August of 2013. I quit my last full-time job in March of 2014. I didn't make more than my 2014 salary until 2022 or 2023. Dia carried us for ~8(!) years while I was throwing spaghetti at the walls to see what stuck.

I haven't actually done the math, but I'd bet a lot of money she outearned me throughout the bulk of our marriage. And because she did that, it gave me the time to "get it together, man".

Sooo...