If you're sick and tired of me talking about renting vs total cost of ownership, feel free to skip this week's email.

However, if this topic does interest you, then you're in for a treat.

This is the first time I'm doing a case study where the unit for rent and the unit for sale are two identical townhomes in the same community.

In other words, it's an apples-to-apples comparison.

☀️

Livin' La Vida Luna y Luca

What do we think? Is Luca looking more like Prince Ali Ababwa or Abu?

There are two townhomes available in the same development in Livingston, NJ.

One is for sale, the other is for rent.

At first glance, I thought the unit for sale was priced well at $840,000.

I also thought the unit for rent was priced aggressively at $5,100 per month.

So I thought, let me run the numbers and see which one is the less expensive option over 10 years, which is about the amount of time the average family stays in a home.

By the way, if you're unfamiliar with the Livingston, NJ market, let's just say it's a middle / upper-middle-class suburb of NYC that boasts a top 10 school district in NJ (according to Niche.com).

Total Cost of Ownership

Homeownership comes with a handful of phantom costs.

In no particular order, they are:

- Mortgage Interest

- Property Taxes

- Insurance

- Routine Maintenance (lawn care, snow removal)

- Capital Expenditures (windows, siding, roof, appliances)

- Closing Costs (purchase & sale)

Mortgage Interest

With an $840,000 purchase price, we can make the following assumptions

- 20% Down - $168,000

- 80% Loan - $672,000

The current 30-year fixed rate for an 800+ credit score borrower is roughly 7.36%

The principal and interest payment is $4,634 per month.

According to the amortization schedule, interest paid over the first 10 years is $462,013 or $3,850/mo.

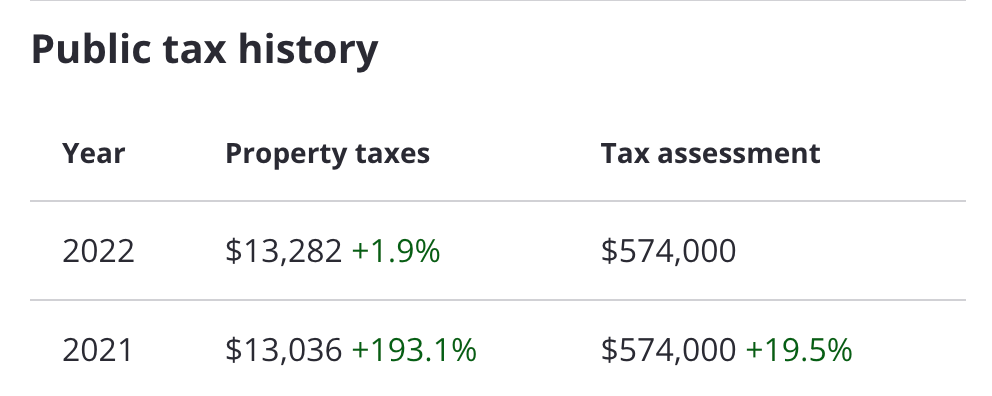

Property Taxes

According to Zillow, the property taxes on the unit for sale are $13,282 as of 2022 up 1.9% from 2021. If we add another 1.9% to the 2022 figure, we get $13,543 or $1,127/mo for 2023 and beyond.

Insurance

Insurance on this home would be roughly $1,800 per year or $150/mo.

Routine Maintenance

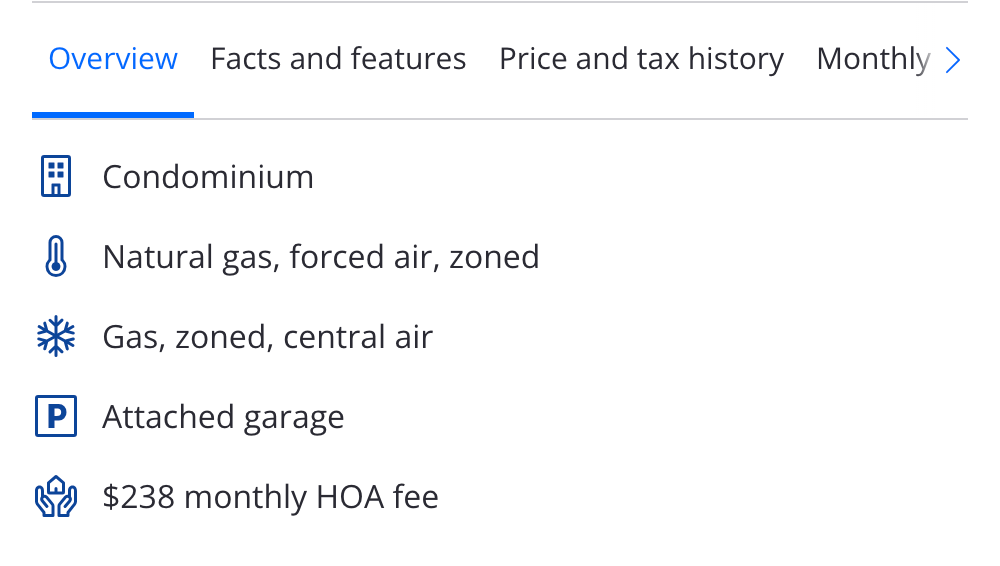

Since this is a townhome development, there is an HOA. According to Zillow, the HOA fee is $240 per month, which actually seems awesome.

Capital Expenditures

CapEx is really hard to predict, especially in a development with an HOA. All of the exterior work is covered (roof, siding, windows, etc).

The only thing you have to plan for is interior work like appliances, HVAC, or plumbing issues.

People typically use 1% of the purchase price for an annual CapEx number on a single-family home, so let's instead use .5% and call it $4,200 per year or $350/month.

Closing Costs

Buyer's closing costs are minimal at roughly 2% of the transaction (transfer tax, title, legal, etc.)

The seller's closing costs, however, are closer to 8% of the transaction price (agent commission being the biggest factor).

So if we take 2% of 840,000, we get $16,800 as purchase closing costs.

If we assume a 1.5% annual appreciation, that computes to a sales price of $960,000 in year 10.

8% of $960,000 is $76,800, which brings our total purchase and sale closing costs to $93,600 or $780/mo over 10 years.

Adding it all up

- Mortgage Interest - $3,850/mo

- Property Taxes - $1,127/mo (assuming no growth)

- Insurance - $150/mo (assuming no growth)

- Routine Maintenance - $240/mo (assuming no growth)

- Capital Expenditures - $350/mo (assuming no growth)

- Closing Costs - $780/mo (assuming: 2% of purchase price and 8% of sales price after 1.5% annual appreciation)

Total Cost of Ownership: $6,497/mo ($5,857 without factoring in closing cost of sale)

Total Cost of Rent

$5,100/mo. Maybe that number increases by ~2% per year.

So after 10 years, you're paying $6,100/mo, which is still less than the 10-year average of TCO.

The good thing about rent is that it's the most amount of money you're going to pay to live in your home (excluding utilities, of course).

The not-so-great thing about a mortgage payment (principal, interest, mortgage, and insurance) is that it's the LEAST amount of money you're going to pay to stay in your home.

What About Appreciation?

We can factor in appreciation... as long as we also factor in the opportunity cost of a down payment.

So in this scenario, we assumed an annual appreciation rate of 1.5%, bringing the home's value to $960,000 in year 10.

After closing costs of 8%, our gross margin is $883,200 or a $43,200 premium to purchase price (not incl. purchase closing costs). More like $26,400 after purchase closing costs factored in.

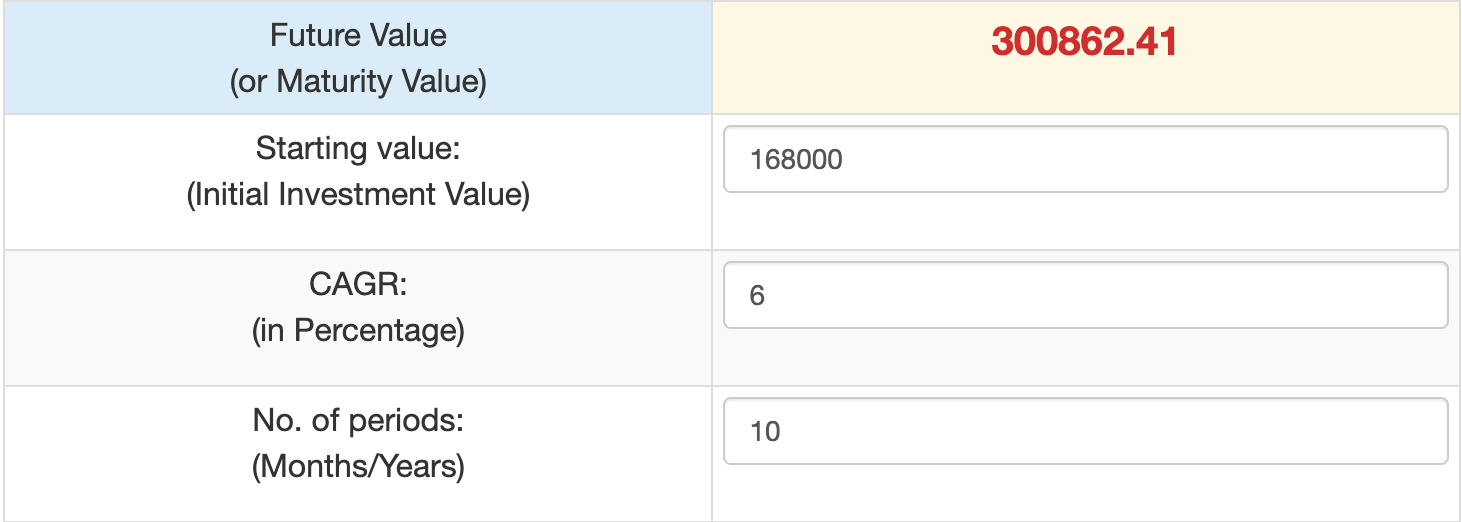

Let's compare that $26,400 bump to the opportunity cost of the down payment.

If someone puts 20% down on this home, they'd have to lock up $168,000.

If they kept that money in a High Yield Savings Account (HSYA), they'd generate ~4.5% in interest income annually.

If they kept that money invested in an SP500 index fund, they can expect it to appreciate at roughly 8% per year.

Let's split the difference and conservatively call the rate of return 6% compounded annually for 10 years.

We'd end up with $300K on our $168K invested, or a $132K bump.

$132K sounds a lot better than $26K to me.

That's not even including potentially investing the difference in money saved every month while renting, which came out to another ~$700/mo.

Obsessed With Ownership

I feel like we, as Americans, are taught to obsess over ownership.

I've run the numbers on renting vs. owning in dozens of scenarios. I'm still shocked every time I find renting come out ahead as the better financial decision.

But it's not only about the numbers.

It's also about a feeling. It feels nice to:

- Put down roots.

- Customize a piece of property to your liking in a way you can't do with rentals.

- Know the property won't be sold out from underneath you - or - the monthly rate won't unexpectedly jump more than a point or two per year.

Buying the American Dream...feels nice.

So What Would You Do?

Rent at $5,100/mo?

Or buy an equivalent property with TCO of $6,497/mo ($5,857 without factoring in closing cost of sale)?

What if I said... there was a 3rd option?

Another identical unit in the same development renting for $4,400/mo. $500 in savings simply because this one is listed as a 3 bed with a flex, instead of a 4 bed.

This homeowner should fire their agent, ASAP. 😂🤦♂️