Gmorning to everyone except the people who don't have seasonal allergies.

If your eyes haven't started burning or your nose hasn't started leaking - we can't be friends for the next 6 months.

Real friends suffer together 😤

☀️

Livin' La Vida Luna y Luca

Not a crime scene - Luca just had blackberries for the first time.

He does look guilty AF though.

"I can be your blanket, daddy" were her exact words.

I've been racking my brain about selling my 2 remaining investment properties.

I've spent the last few talking about it to anyone who would listen.

I'm so desperate to come to a conclusion, I even asked Chat GPT!

After some light hedging, It gave a pretty thorough answer.

Let's tackle these factors one by one.

Market Conditions

Despite what the media might have you believe, the market for decent homes in desirable neighborhoods is still strong.

The 4-family property appraised for $589,000 in the Spring of 2021.

We just spent $15,000 renovating the final legacy unit, so I have to imagine it can sell for at least that amount today.

The 3-family property appraised for $320,000 in the fall of 2021.

Coincidentally, we just spent $15,000 renovating one of the units there as well so I have to imagine it would sell for at least that amount today.

So we're looking at a total outsale of $909,000.

After including the cost of sale (5%), the net sales number would be closer to $863,550.

Cash Flow Needs

Chat GPT says, "if you need cash to cover other expenses, selling may be a good option."

The word "other" is loaded. If you're selling an asset to cover lifestyle creep, take a step back. If you're selling an asset to fund medical bills, that's a different story.

Regardless, neither applies to me. I am not selling because I need the cash. In fact, any proceeds from the sale would be completely and immediately reinvested.

So how much cash do I stand to walk away with if I decide to sell?

Well, we already know the net sales amount is $863,550.

Now let's back out what we owe on each property.

We currently owe $428K on the 4-family.

We currently owe $250K on the 3-family.

My equity share in these properties is 75%.

(+) $909K - Gross Sales Price

(-) $45K - Cost of Sale

(=) $$864K - Net Sale Price

(-) $428K - Loan 4-Unit

(-) $250K - Loan 3-Unit

(=) $186K - Net Profit

(*75%) 140K - Sunny

(*25%) 46K - Partners

Tax Implications

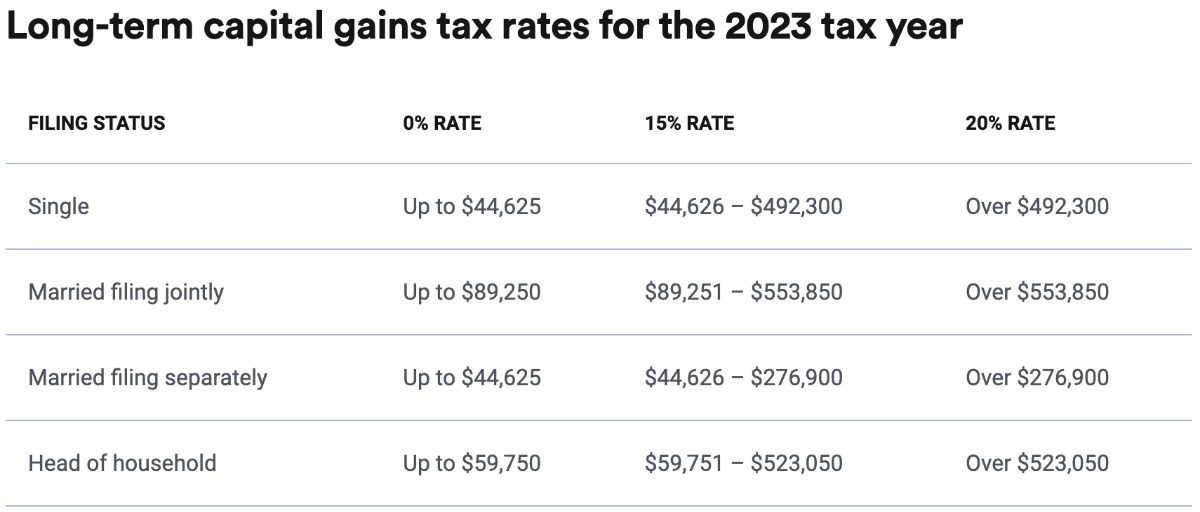

We've had both of these rental properties for more than a year so these sales will be taxed as long-term capital gains.

LTCG is 0%, 15%, or 20% depending on how you file and how much you earn.

Here's the chart for 2023.

There are, of course, ways around paying taxes (at least in the near future).

I won't go into them here, but a couple of options would be:

- 1031 Exchange

- Opportunity Zone Fund

Long-term Investment Strategy

Here's where things get a little sticky.

You might recall, I sold all of my rental properties (~15 units) last year, EXCEPT for these two.

I decided to hang onto these properties because I bought them with a very specific purpose in mind.

These two properties are supposed to fund my children's college educations. I also imagined they'll help with wedding costs, and maybe even a down payment on their first homes.

If I sold these properties, I wouldn't necessarily be giving those benefits up as I'd likely reinvest the proceeds from the sale into another asset that would provide similar benefits - but it does feel a little like I'm potentially "jeopardizing" their future.

Ugh - TFW emotions find their way into financial matters.

2 Things Chat GPT Didn't Mention

- ROE (Return on Equity)

- Investing for Lifestyle

Let's tackle these separately.

ROE (Return on Equity)

Return on Equity is exactly what it sounds like:

How much money did your property make (profit) compared to how much money you have tied up in it (equity)?

ROE = Net Income / Shareholder Equity.

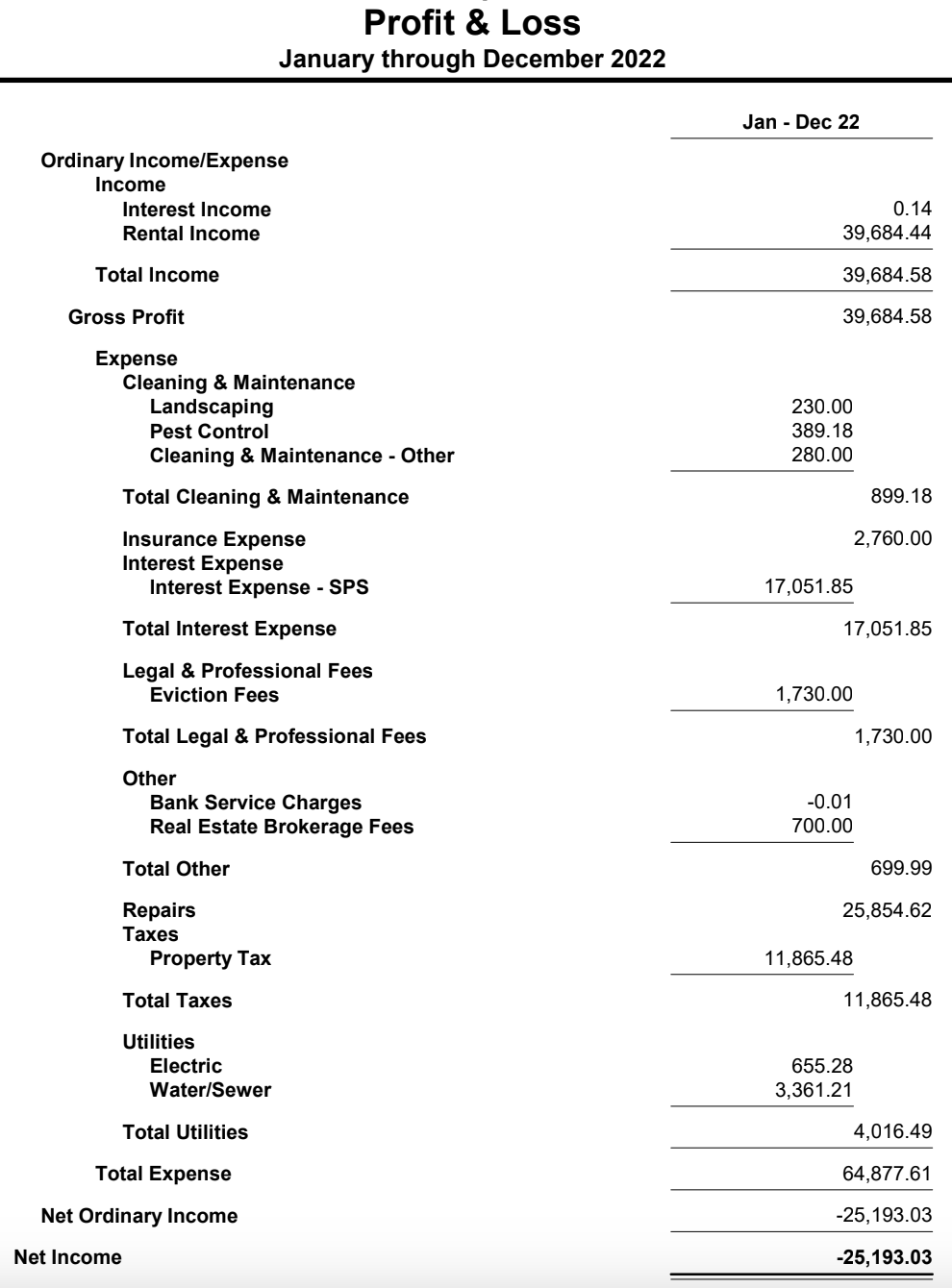

We lost $25K on the 4-unit in 2022. So the ROE was:

-25K / (589K - 428K) = -15%

Yikes.

The NOI in '22 was disastrous because we had a few tenants who simply did not pay their rent for an extended period of time.

We only collected $40K in rent.

In a perfect world (100% occupancy & collections) we should be able to generate a top-line revenue of:

- 12 months x 4 units x $1,350/unit = $64,800.

That's actually worrying because that perfect scenario would only bring in ~$25K more, which means we'd simply break even.

The other culprit in our P&L for 2022 was the Repairs line item - $25K.

One of the tenants we evicted trashed her unit before leaving and it cost north of $15K to bring it back online.

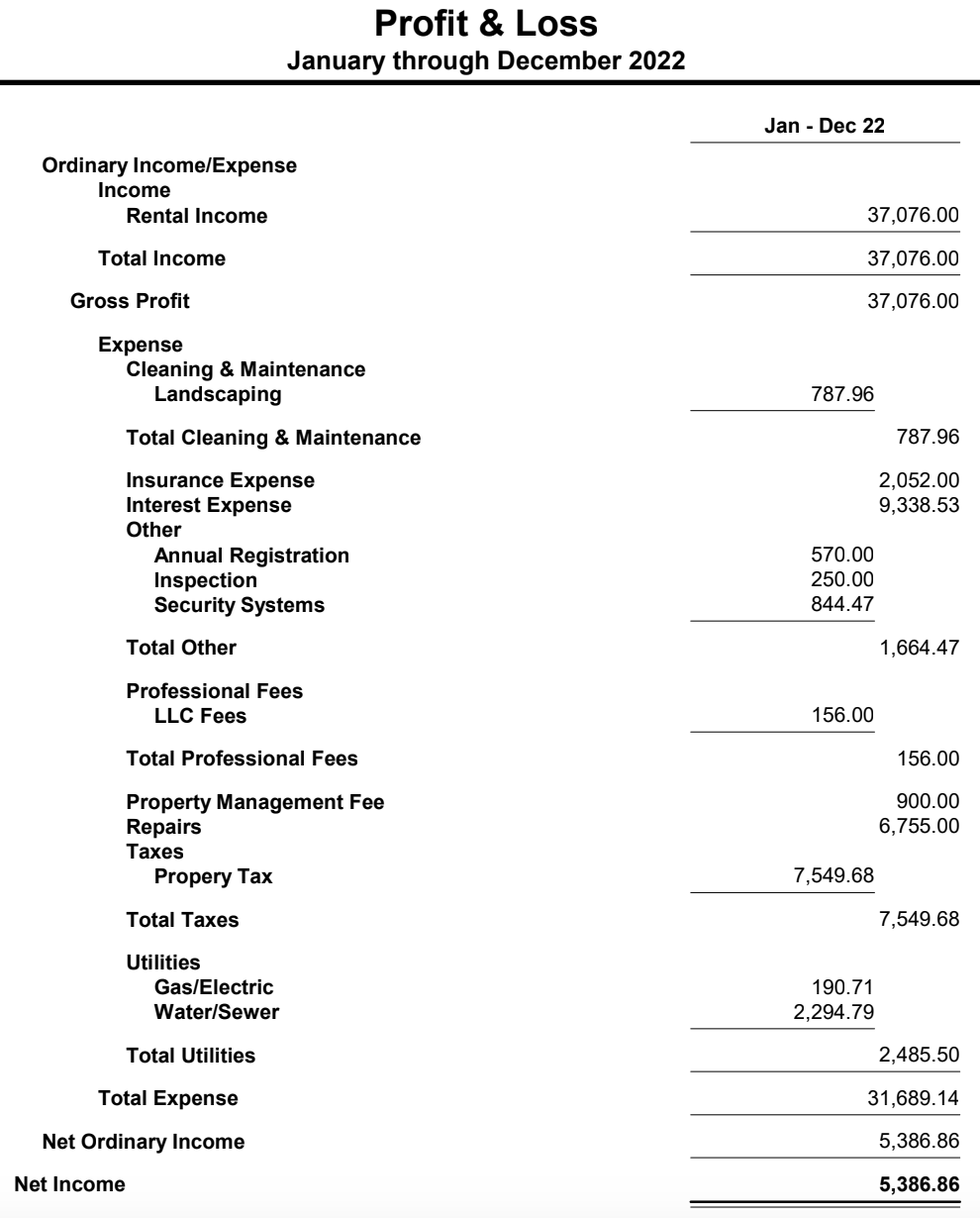

We made $5K on the 3-family in 2022. So the ROE was

5K / (320K - 250K) = 7%

Not bad, actually. I can live with that.

There was, however, a 10K gap between what was collected and what was possible.

- 12 months x 3 units x 1,350 = $48,600 (Gross Potential Rent)

Investing for Lifestyle

I once heard someone say: "Every investment you make - whether it be time, money, or otherwise - should improve the quality of your life".

Of course, we have to consider delayed gratification, but I do generally subscribe to this framework.

I'm not trying to make an investment that makes my life worse. I've done that before. Never again.

Objectively speaking, these two properties were huge financial wins. Especially considering they were my first two investments as the lead investor.

We bought the 4-unit for $240K, spent $160K renovating it, and it appraised for $589K once we were done. We created almost $200K of value in a year.

The 3 unit had a similar story on a smaller scale. We bought it for $215K, spent $45K renovating it, and it appraised for $320K once we were done. We created $60K of value in a year.

However, it's been downhill since then.

The eviction moratorium left us holding the bag on $25,000+ in unpaid rent.

The type of tenants these properties attract tend to leave the unit in shambles when they leave.

Despite doing a thorough cosmetic renovation, there is still a ton of deferred maintenance, especially when it comes to the mechanicals, electricity, and plumbing (which are obviously the big ticket items).

These issues weigh heavily on me. I'm not even the one dealing with the blowback. My partners manage the operations, but it still takes up mental space in a negative way.

Hindsight is 20/20. The optimal move would have been to sell these properties as soon as we were done with the value-add component to ultimately avoid the operational / market risks for the past 2 years.

But it's not too late to correct the mistake.

I think my next move is to engage the same agent I used to sell my 4-unit mixed-use property and see what his BPO comes in at for these two properties.

If we can achieve similar numbers to what we appraised for back in 2021, I might have to move forward with the sale and repurpose these funds into a new opportunity.

Stay tuned.