I'm. So. Tired.

I think the new year high finally wore off and everything caught up to me.

Things aren't slowing down though. We made 2 offers in Philly last week and we're hoping at least 1 sticks 💪🏽.

☀️

Livin' La Vida Luna y Luca

When it's this cold we break out the hand-me-down Patagucci for Luca.

It feels like I spent the entirety of last week just looking at numbers.

I finally got back into making video content!

And I got an early look at the 2022 Profit & Loss Statements for my 2 remaining rental properties (7 units).

Let's dive in.

Video Content

This time around I'm exclusively creating shorts format (< 1 min vids).

We're publishing to YouTube, Instagram, and TikTok.

Here's how we're doing on views:

TikTok

TikTok is hilariously bad. After uploading 9 videos, we have 41 views.

I must have done something wrong or left something incomplete when creating my profile because I'm pretty sure someone without a pulse could have managed to garner more views.

If you know anything about TikTok, please hit me up. Would be much appreciated. 🙏🏽

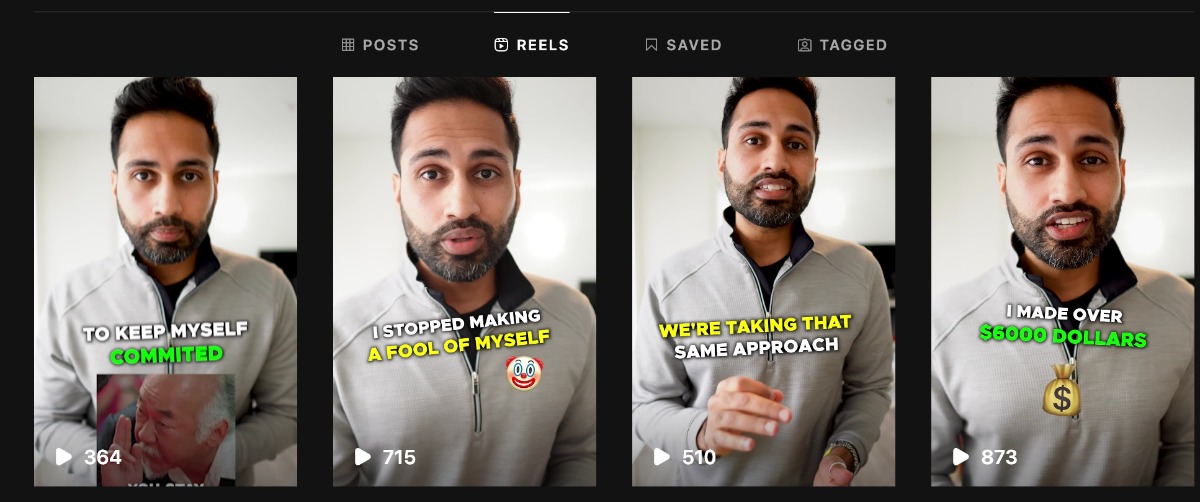

Instagram Reels, on the other hand, are doing much better than TikTok.

In just 4 days, my videos have been viewed ~2,500 times, reaching 1,133 accounts (more than half are non-followers).

That's pretty sick.

Gettin' some good feedback.

And some questionable feedback.

YouTube

If someone put a gun to my head and said I can only publish short form content to one platform - the choice would easily be YouTube.

Aside from being the video based platform I enjoy the most, it's the only one that's easily searchable and indexable.

I don't even have IG or TikTok on my phone. 🤷🏽♂️

Anyway...

YouTube Shorts leads the pack with nearly 7,000 views since publishing my first video on the platform on January 24th.

Last year, I published 1 long-form video to YouTube for 26 weeks straight and I think only one video reached the 1,000 views mark.

This time around, 3 of 7 videos cracked 1K views and one more is knocking on the door.

2022 Rental P&L's

Rental properties are such a drag.

That's why I sold everything last year, EXCEPT for the 2 properties that are supposed to fund Luna and Luca's education.

It will be a miracle if I'm able to hang on to these 2 properties for the next 18 years.

Champion

First let me say that one of my partners on this rental is a CPA. My goodness, that's a clean P&L. Gjob, Marc!

OK - Back to the #s - Here's where I get a little frustrated.

This is a 4-unit property that is supposed to collect $5,200/mo in rent ($1,300/unit).

$5,200/mo is $62,400 in Gross Rents per year.

We only collected $39,684 in 2022 🤮. That's 63% of Potential.

Roughly half ($17.5K) of what we collected came from Government Sponsored ERAP (Emergency Rental Assistance Program).

The saving grace on this property is our equity and loan terms.

We bought and renovated this property for $400K and it's worth about $600K (as of Spring 2021).

It was financed at 4% fixed over 30 years. Not seeing those rates again anytime soon so we continue to hold despite the significant losses we took this year.

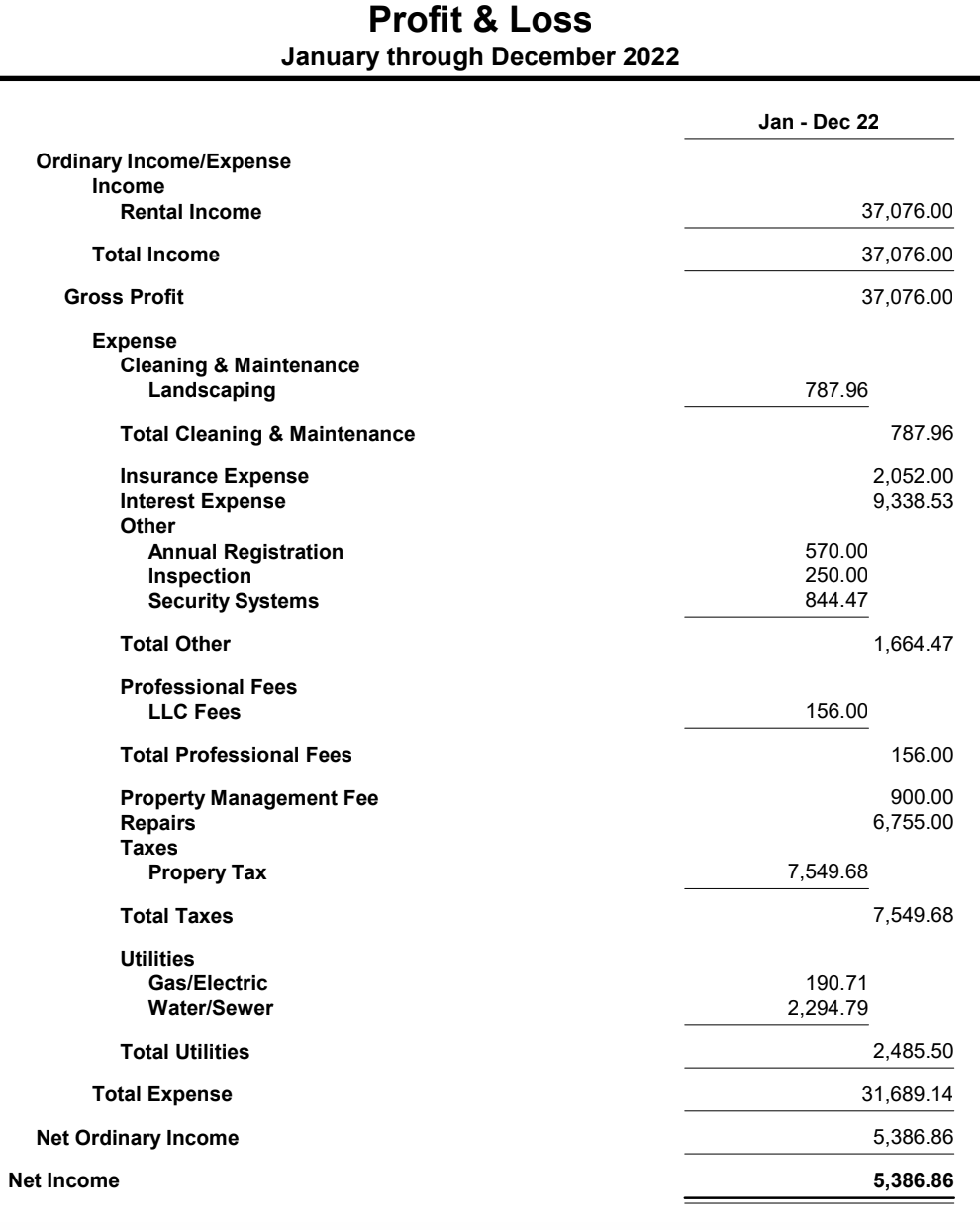

Walnut

Rental Property #2 came in slightly better. We actually made a profit!

This 3 unit property rents for $3,650/mo or $43,800 per year.

We collected $37K (85%) of potential.

This property subsidized all of the loss we took on property 1, so this is sort of the star pupil of the portfolio.

We bought and renovated this project for $240K and it's worth ~$320K (as of Fall 2021).

Not quite as much equity here, but the loan terms are also 4% fixed for 30 years.

I have to consistently remind myself to take the long term view. I've completely abandoned any expectation of receiving cashflow from these rentals.

I've learned to be grateful with the loan being paid down by the people living there, which adds ~$1,000/mo in equity across both properties.

-

I hope I didn't bore you to death with all this numbers talk.

Just want to provide a behind the scenes look into what's possible when publishing short form video content to TikTok, IG, and YouTube - as well as what you can expect when buying rental properties (from a P&L perspective).