Major shoutout to my friend and business partner, Francis Mangubat, for making this dream a reality.

What an incredible experience.

Especially grateful I got to share it with Dia.

☀️

Livin' La Vida Luna y Luca

Matching outfits at The Franklin Institute this weekend.

Your boy did it again. When will I learn?

I counted my chickens before they hatched. 😭

In last week's newsletter, I shared that I had a new construction opportunity on the hook in Florham Park, NJ.

The seller accepted my offer and we made it to the Attorney Review stage.

Unfortunately, the sellers' attorney immediately killed the deal. They didn't like my offer had only a 10% down payment and no interest associated with the seller-financed loan.

So I countered myself in an attempt to save the deal - I upped my down payment to 20% and offered to pay 4.5% interest on the loan amount.

But it was too little too late. The damage was done and the seller was properly spooked.

The Worst Part

Potentially losing this opportunity over deal terms isn't even the worst part.

The real blow is that my email from last week generated a ton of interest.

What's a ton? $675,000 to be exact.

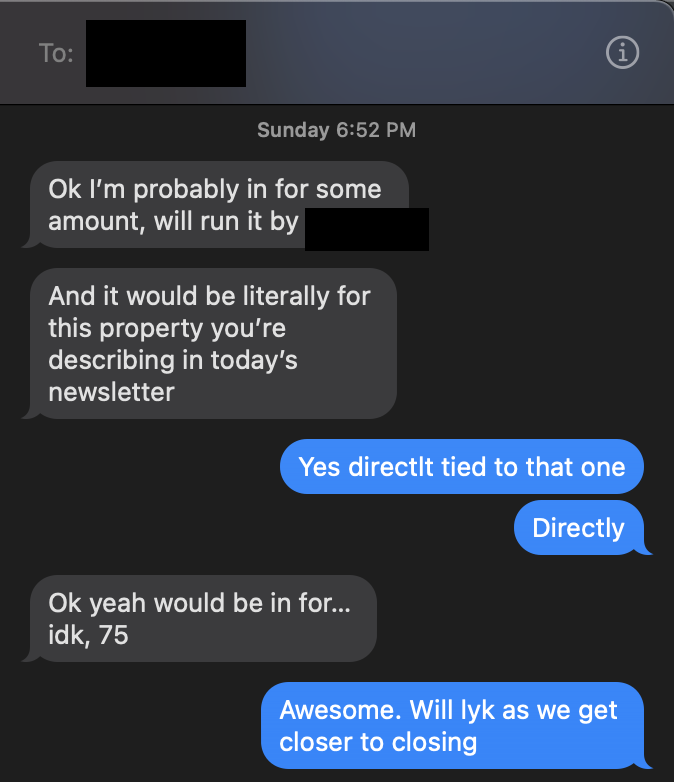

An old friend was in for $75,000.

Another investor was in for $100K.

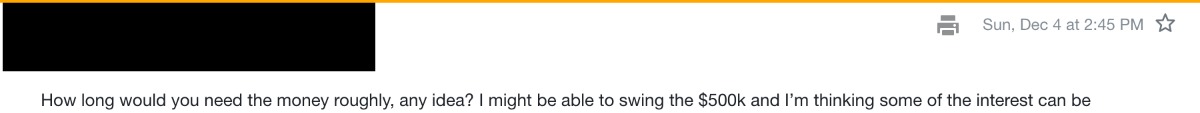

This one brings a tear to my eye 🥲. One investor expressed an interest to fund me to the tune of $500K.

Don't Go Chasin'

Raising this amount of money from one email is mind-blowing.

Not being able to deliver on the project is disheartening.

But I'm also not going to chase this new construction deal just because the money is available to me.

The deal made sense as long as at least 80% of the purchase amount was seller-financed at less than 4.5%.

But using hard money to finance the deal at current rates (12%), the profit margin becomes too thin.

All Hope Isn't Lost

We just had another offer accepted in Philadelphia. This one is in Queens Village.

We're converting a side-by-side duplex with separate entrances and utilities into 2 separate row homes.

It's not as "big" of a deal as Florham Park was, but it is just as lucrative.

High Level #s:

$580K - Purchase Price

$150K - Renovation

$1.05M - After Repair Value

Shifting The Money Around

I'm trying to move the $75K investor to the flip we're currently doing in Philly (closed last month).

Then I'll request $180K from the $500K investor on our new opportunity in Philly. That'll fund the down payment ($120K) and get us through our first construction draw ($60K).

The $100K investor will likely sit on ice, but hopefully for not too long.