Just when I was afraid things were slowing down, a buddy called with a new opportunity in New Providence. 🏚

More to come on that after we close. 🤞🏽

Livin' La Vida Luna

There's a new "L" Woods in town.

IYKYK.

In 2020, I bought 3 properties (11 units total) with the help of my business partner. He found them, I financed them.

In 2021, I decided to take matters into my own hands by running a 7-month experiment that cost me ~$10,000.

I sent ~1,500 postcards per month to small multifamily homeowners with some level of distress.

From that effort, we secured 3 deals (awful conversion rate).

The first was a duplex listing in Passaic. I made a referral fee of like $3K on it. Yayy. Not.

Another was a wholesale transaction for a quadplex in Elizabeth. The property flooded while we were under contract. We sacrificed some of our profit to the end buyer to keep the deal alive. I made about $4K on that one. Blah.

The third property was the triplex we just sold. That's the one that ended up "returning the fund."

The Numbers

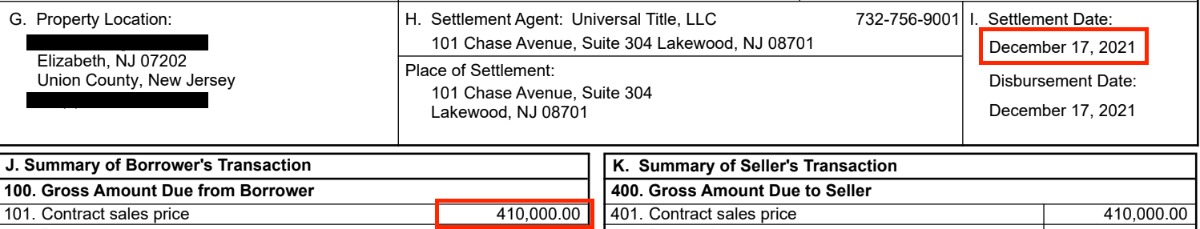

We bought the property on 12/17/21 for $410K. Our original plan was to fix and flip it.

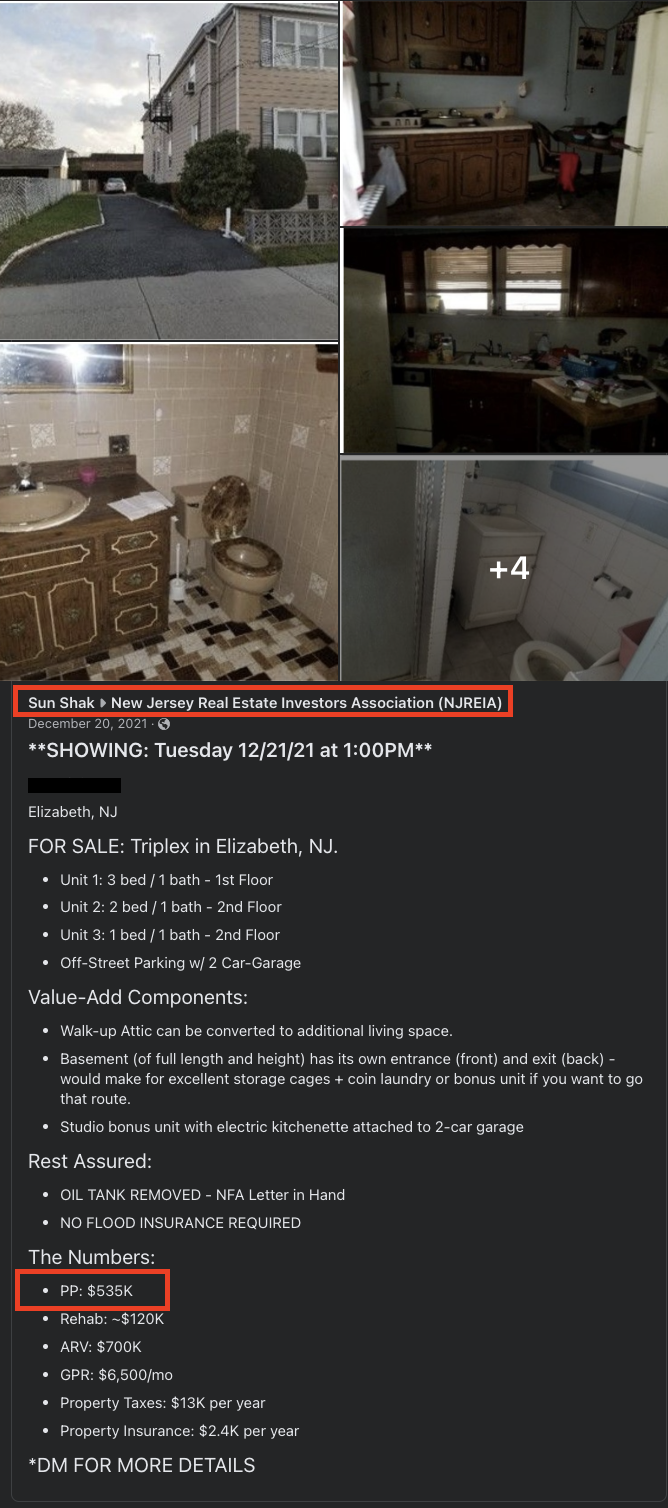

A few days later, I posted the property to the NJREIA Facebook Group to schedule a showing for investors. I "listed" at $535K.

If we could make a hundy pop ($100K) without doing any further work, why not?

After that showing, we verbally agreed to sell for $515K. 💰

There was just one major problem: our hard money loan came with a 6-month prepayment penalty.

We owed our lender 6 months of interest, no matter what. Additionally, we owed a 2% fee on our total loan amount because we didn't use any of the construction funds.

Lesson learned: read the fine print when signing loan docs.

Between interest and fees, the prepayment penalty worked out to be ~$25,000.

Creative Deal Making 101

We weren't willing to give up 25% of our gross profit to interest and fees so we had to get creative.

We took a two-prong approach.

First, we signed a 12-month lease option contract with the buyer.

A lease option is an agreement that gives a renter a choice to purchase the rented property during or at the end of the rental period.

The lease portion was $4,000 per month and the buy option was $515,000.

The $4,000 per month was meant to cover our carrying costs.

- ~$1,000 per month in property tax

- ~$300 per month in property insurance and utilities

- ~$2,700 per month in interest ($400K * 8% / 12)

To protect ourselves, we asked the buyer to escrow 6 months of rent upfront.

That $24,000 covered all of our carrying costs until the sale.

Secondly, we hired our buyer as our contractor.

Since the property was ultimately going to be his, we allowed him to improve the property on his own dime.

We agreed to reimburse him periodically if he could provide receipts for labor and materials.

Every dollar we reimbursed him was then added back to the purchase price.

He spent 5 months and $90,000 on the renovation. That increased the purchase price from $515K to $605K.

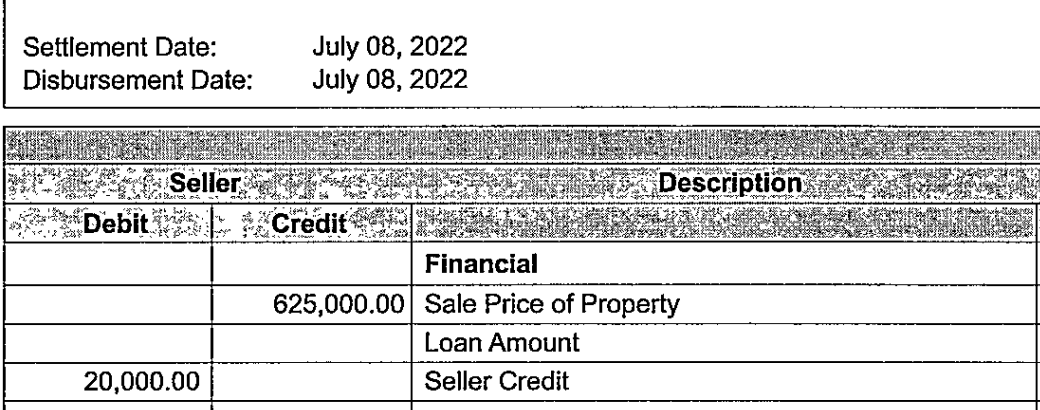

We made these agreements on January 17, 2022, and sold on July 8th, 2022.

In an effort to alleviate his out-of-pocket closing costs, we bumped up the purchase price to $625K and provided a seller credit for $20K.

We're still waiting on a few lingering transactions, but when the dust settles, this deal will come in at $75K net profit for the business.

+ $625K - Sales Price

- $20K - Sellers Credit

- $5K - Cost of Sale (Direct Sale - No Agent)

- $90K - Rehab Reimbursement

- $410K - Purchase Price

- $15K - Cost of Purchase

- $10K - Due Diligence / Inspections / Tank Removal

= $75K - Net Margin

Before this deal, we couldn't even break even on the postcard experiment.

Thanks to this deal, we achieved a MOIC of 8 (multiple on invested capital).

Not too shabby. Now we go back to work.

--

Resources: