I've been rambling on about trying to sell 3 different properties for a few months now.

We finally closed on one this past Thursday.

Continue reading for a post-mortem on numbers and a few reasons why we sold.

Livin La Vida Luna

Dora La Exploradora vibes.

🏪

People say cars lose 10-20% of their value as soon as you drive them off the lot.

The same idea holds true for real estate. But it's not because of depreciation, it's because transaction costs are so damn high.

The Numbers

We finally closed on the sale of our 4-unit mixed-use property.

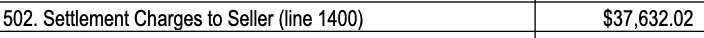

Although we booked a huge gain, I still get sticker shock every time I see settlement charges.

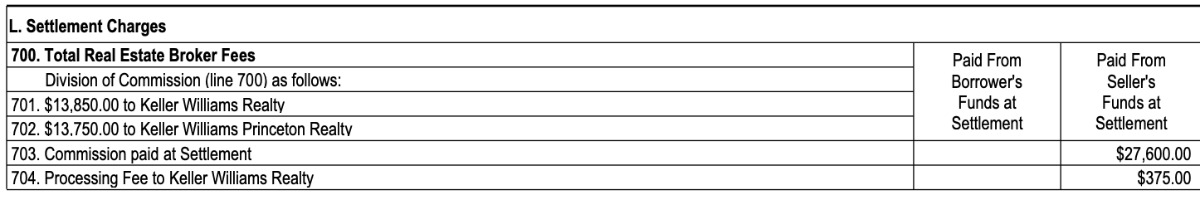

The bulk (75%) of the settlement charges came from Total Real Estate Broker Fees. I can't be too mad about that. We had an excellent agent in my friend, Brian Colonna.

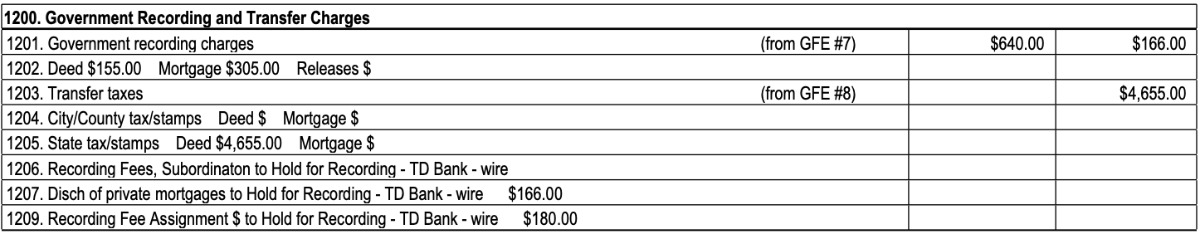

The next largest portion (12%) was Transfer Taxes. Where does this money even go?

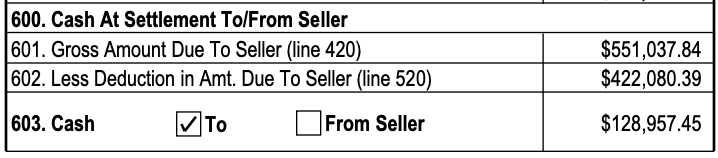

We sold this property for $550K after buying it a little over a year ago for $315K.

We spent $45K on renovations so our gross margin was $190K (550-315-45).

Our net after all deductions was $129K.

Why Did We Sell?

1) Cash flow is King (but Appreciation is Queen).

When we bought this building, it was generating $3,600 per month in rental income. After renovating a few units and monetizing most of the unused space (basement and garage), we got this property up to $5,550 in monthly rents.

With a basis of $360,000 our Rent To Cost (RTC) Ratio was 1.5% ($5,500 / $360,000).

Finding RTC ratios greater than 1% in today's market is damn near impossible.

From a cash flow perspective, we were golden. But strong cash flow is only half of the game. It's a defensive metric against a shrinking market so you can continue to service your debt.

On the other hand, appreciation is the offensive metric that helps grow your wealth much more rapidly.

We forced $190K of appreciation in one year by renovating the property and raising rents. Generating that type of capital on cash flow alone would take 20 years.

2) Marginal Benefit

It's difficult to predict appreciation, but it basically comes down to location and asset type.

Considering this was a mixed-use property in a very small blue-collar town, we estimated our annual rate of appreciation would be in the range of 1-2%.

After increasing the value of the property by 50% (550/360) in one year, hanging on for a mere 1-2% per year thereafter seemed inefficient.

3) Taking Chips (Risk) Off The Table

Crunching numbers in spreadsheets is cute. But at the end of the day, a business (or property) is worth what someone else is willing to pay for it.

Our original plan was to keep this property as a long-term rental. Once we completed our renovations, we went to a local bank to refinance into long-term fixed-rate debt. They valued the property at $450,000.

They were going to give us a loan for $340,000 (75% LTV) so we'd be required to leave $20,000 in the deal.

But based on our Net Operating Income (~$40,000), we felt that valuation was way too low. So I hit up an old friend and asked him to list the property for $500,000 just to see how the market would react.

To everyone's surprise, we received multiple offers above our asking price. We ultimately selected the highest offer at $550,000. The second highest offer was $535,000.

Regardless, there was a +$100,000 delta between what our bank thought the property was worth and what the market deemed it was worth.

We decided that premium was too good to pass up. We were also afraid the market could turn and it would be years before we see this type of valuation again.

I'm not advocating timing the market. I'm advocating striking while the iron is hot. 10 years from now we may look back at our decision to sell as a mistake.

However, based on the information we have today, it kind of feels like we pulled a rabbit out of a hat. 🐇